Many sectors of value stocks have been murdered with horrible under-performance over the past decade to 14 years. Set the Fed Funds Rate to zero, have the ECB go negative with rates and even Greek bonds throw up a negative yield. Literally junk bonds with negative yields.

Greece’s three-year debt turned negative on Friday, and then the country received more good news after the surprise decision by Moody’s Investors Service on Friday night to upgrade the nation’s debt. The upgrade, from Ba3 from B1 previously, still leaves Greek debt in junk market territory, and three notches away from becoming investment grade.

With such a low benchmark from bonds, shouldn’t value stocks look relatively attractive?

Even the Greek 10-year recently yielded 0.77% down from 35% in 2012. How dystopian does one’s view of the future need to be in order to justify those prices? And if one’s view is that dystopian do they think central banks won’t print & should they be in government bonds? Wouldn’t they be better off in gold, with a small slice of gold miners and bitcoin?

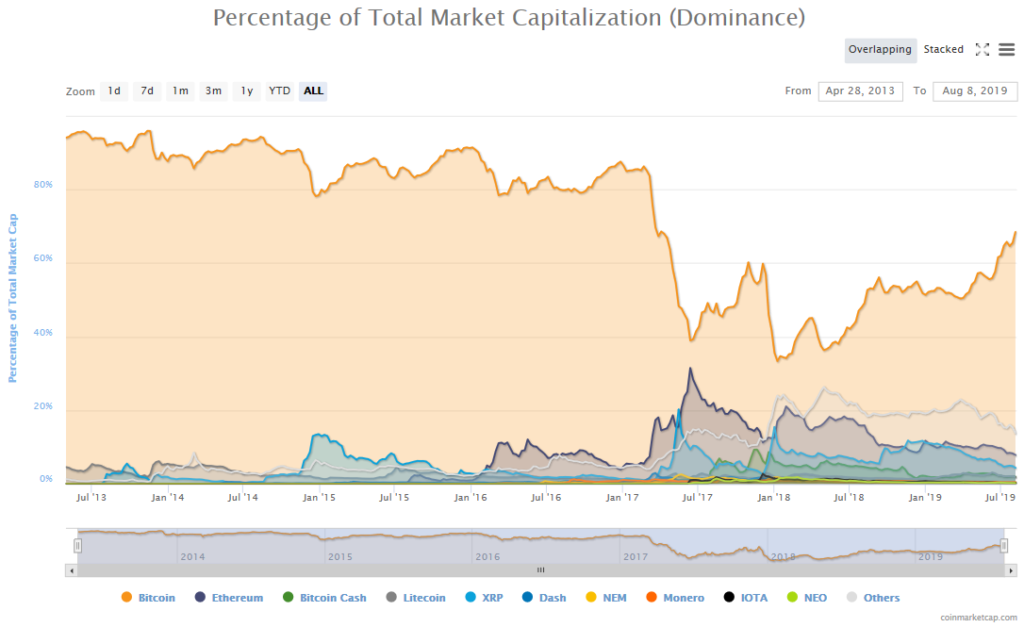

There are a couple big pieces of value under-performance. With central banks paying nothing the value of far off growth is higher & with the COVID-19 lockdowns murdering the value of physical infrastructure while attention and activity moves online, that creates a hell of a lot of momentum for high-margin fast-growing software & digital platform plays. And at some point momentum creates its own media coverage, brand value & further self-reinforcing momentum – at least until something breaks.

The Wall Street Journal noted a big part of the recent underperformance of value stocks was due to not valuing intangible assets correctly.

Intangibles refer to a company’s investments in things such as research and development, patents and intellectual property. Generally accepted accounting principles (GAAP) treat such investments as an expense rather than an asset on the balance sheet, so instead of being viewed as something that potentially enhances a company’s value, intangibles are treated as something that reduces it. “That makes no sense,” Prof. Harvey says.

The study they cite mentioned how intangible assets went from being 25% of book value to 100% of book value from 1963 to the early 2000s.

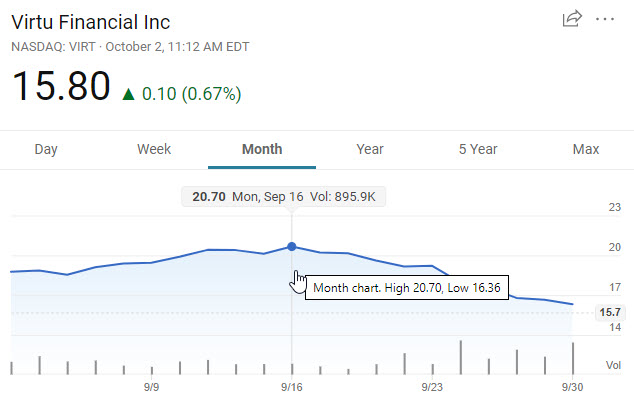

What’s more with the above is many online plays tends to lead to monopoly market dominance to where the dominant player can give kickbacks to prevent competition from entering the market.

Google owns search. When the UK studied the search market they found even if Bing gave Apple a 100% revenue share that would under-earn what Apple earned from selling the Safari default search position to Google.

Facebook owns social. Twitter trades around where it did at their IPO. Facebook bought Instagram and Whatsapp. Facebook intervened to get the US political machinery to gum up Tiktok’s growth & prospects.

Google and Apple split the mobile app store game with a fat 30% rake.

Amazon owns e-commerce. Their white label products & large ad unit sizes force brands to buy brand-related ads to protect their pre-existing brand equity. This means Amazon has margins other online retailers can not match & if there is particularly strong competition in a category they can use the subsidized profits from AWS to sell goods below cost in that category to kill their competitor’s growth like they did with Diapers.com. Walmart’s big Jet acquisition changed their narrative but ultimately was a shut down in spite of costing $3.3 billion.

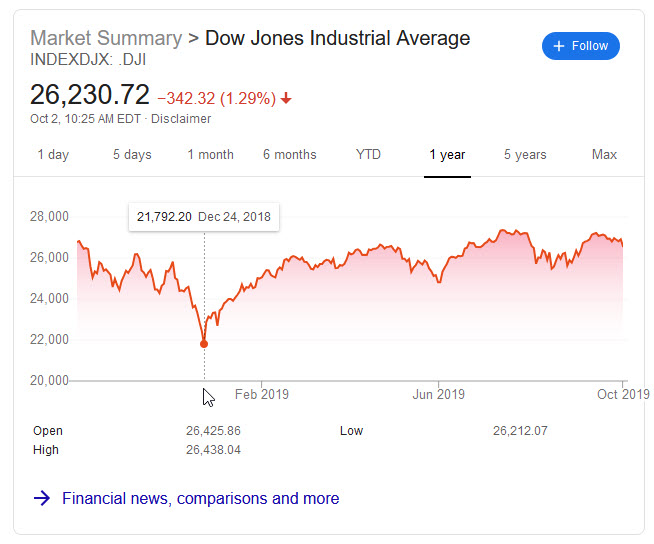

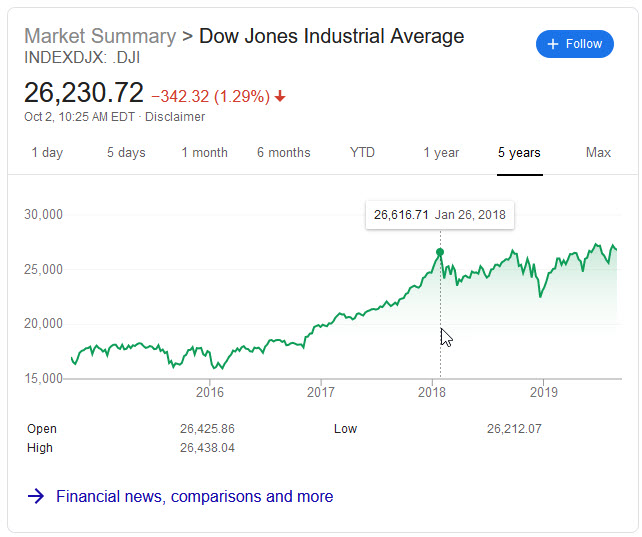

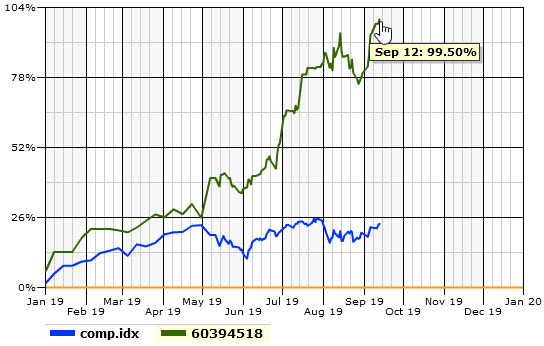

Intangible assets aside, value stocks have had their worst performance in centuries:

According to Mr Samonov, the value factor is now down 64 per cent from its peak in 2007, going beyond the previous record — a 59 per cent tumble suffered from the late 19th century until a nadir in 1904.

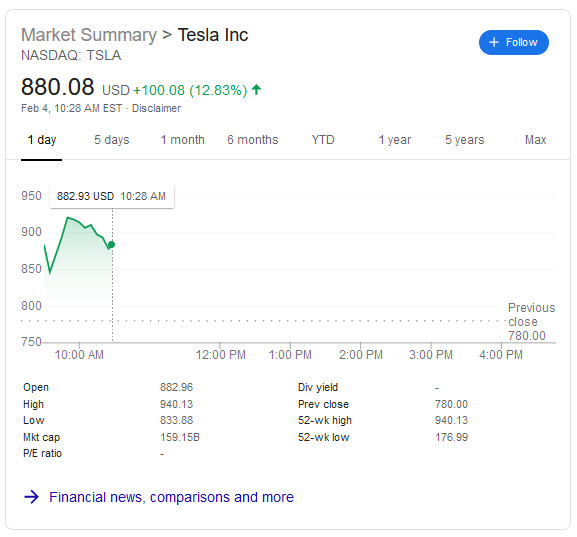

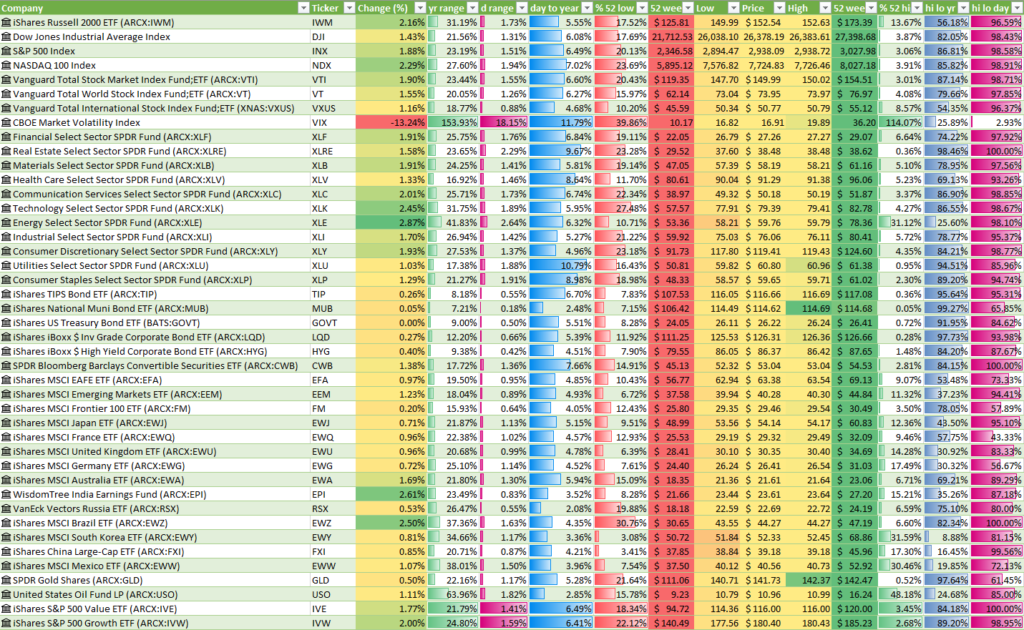

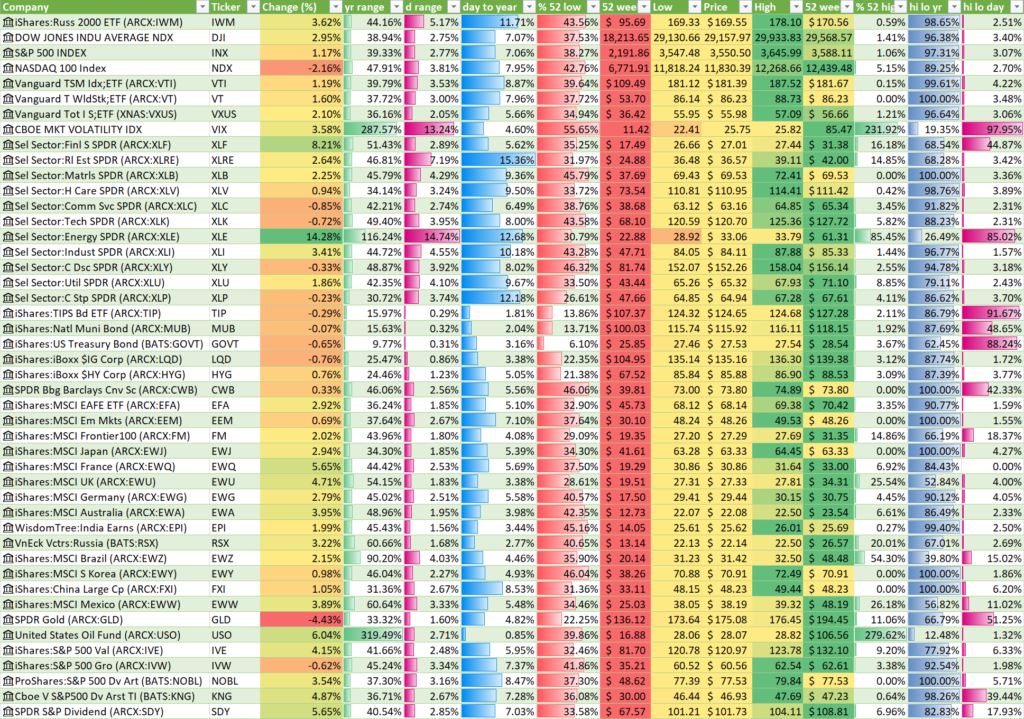

As soon as the election was called journalists were quickly writing about how value will continue to under-perform since there was no blue wave. On Pfizer’s announcement of a 90% effective COVID-19 vaccine (after the election, of course) the stock market was up huge.

“I think people are going to stop having anxiety everyday…I think we see the beginning of the end. That’s a big deal,” said Tom Lee, Fundstrat head of research. “I think the market was happy to wait until we got vaccine progress before we got the rotation. There was a huge amount of underperformance in these cyclicals and epicenter stocks. We could see months and months of this. This could rally for awhile.”

Safe havens like gold (and FANGs) fell while beaten down value sectors like financials and energy massively outperformed technology today.

As much as some habits have moved across online many people want to get out and explore the world, be with friends, and connect with nature. It is hard to suggest Expedia should be at 52-week highs (people want to book a flight & hotel to go across the country or to the other side of the world) while suggesting a Walgreens Boots should be barely scraping along (it is to dangerous to go to the local drug store). At the same time, the market cap of GoodRX is about half of that of Walgreens Boots. Is that sustainable? A fast-growing coupon app worth about half as much as a company that has $140 billion in revenues and serves about half the market?