Today may be the bottom for ExxonMobil. A triple (or quadruple? quintuple? octuple?) lindy of factors confluence in a culmination of pure culmination.

- The stock has went nowhere in a decade & is off about 13% so far this year after under-performing the market last year. We are not trading far off the 2010 lows.

- Jim Cramer compared oil stocks to smoking stocks.

- The stock’s performance is weighed down by cash concerns from counter-cyclical investments – which is when it is best to make said investments:

In 2019, Exxon produced $6.6 billion in free cash flow and spent $14.7 billion on dividend payments. Analysts at the Institute for Energy Economics and Financial Analysis (IEEFA) wrote after the earnings report that the deficit between the company’s free cash flow and its dividend payments is expanding rapidly.

- The Guyana development appears to have some solid economics:

Exxon Mobil Corp.’s oil-production contract with Guyana is so heavily weighted in the supermajor’s favor that it will deprive the tiny South American country of some $55 billion over the life of the agreement, according to human-rights group Global Witness.

- Goldman Sachs finally downgraded the stock yesterday:

The decline came after Goldman Sachs analyst Neil Mehta downgraded shares to Sell from Neutral on concerns that the company’s return on common equity were lagging behind its targets. He dropped his price target to $59 from $72. At the root of these concerns are Exxon’s failures to improve its cash production.

- The PBoC cut reverse repo rates & then injected money into the Chinese market for the second day in a row, causing their stocks to close up on the second day of trading, after a single huge down day tied to the coronavirus outbreak.

- On Monday 3,257 stocks fell by their 10% daily limit: “All but 162 of the almost 4,000 stocks in Shanghai and Shenzhen recorded losses, with about 90% dropping the maximum allowed by the country’s exchanges.”

- Macau is shutting down their casinos for weeks. China is going to keep on printing.

- China complained that the US was both not doing enough about the coronavirus outbreak AND that the US was fanning fears. There is also rumors that the trade deal could be breaking down as China does their world famous after the contract is signed negotiations can begin trick.

- The Federal Reserve is still pumping FOMO into the markets to paper over the coronavirus. If they and China are both pouring money into the markets eventually that is going to spill over into commodity prices.

- Oil prices have fallen the most of any January in the past 30 years, recently entering a bear market. OPEC is conducting a meeting, looking to cut production by a half-million barrels per day. While ExxonMobil may need to sell assets or raise debt to pay dividends, some Middle East countries would outright collapse if oil prices stay low for an extended period of time.

- The stock goes ex-div on Monday & some will buy the recent dip ahead of that (though there will be a downdraft of selling after it).

Buying oil stocks today is the inverse trade of being long Tesla, without the carrying cost of potentially toxic shorts which can trigger margin calls as other shorts are forced to exit their positions, or the theta time decay factor tied to options.

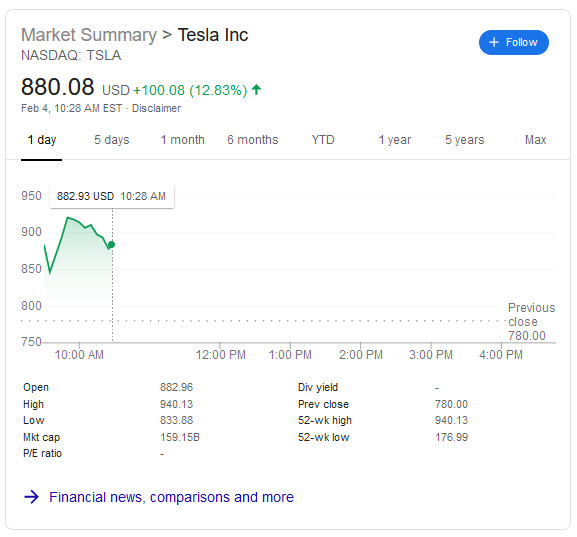

Tesla is up another 16% this morning after jumping nearly 20% yesterday, giving them a market cap of about $158 billion. For comparison sake, …

- Fiat Chrystler is valued at about $26 billion

- Ford is valued at about $36 billion

- Honda is valued at about $47 billion

- GM is valued at $48 billion

- Toyota is valued at about $232 billion

It would take serious balls to short Tesla with any scale. An easier way to take that trade with a bit less leverage is to by a solid oil major. They are beaten down and left for dead.

Commodities have had a brutal run of late

Central bankers & politicians fighting coronavirus with massive stimulus will eventually put a bid under commodities.

If oil stocks have been dead money for a decade is it a sound bet it will be dead money for another decade? Perhaps if you have a $7,000 to $15,000 price target on Tesla, the bitcoin of cars.

Here’s to Tesla’s trillion dollars in annual revenues in the next decade!