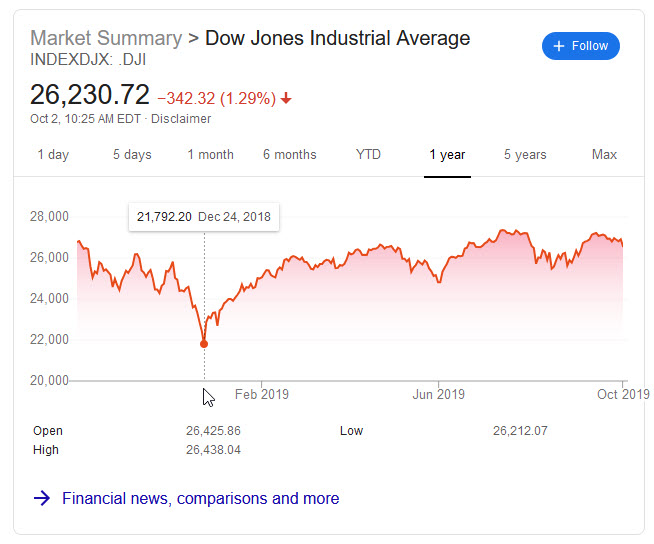

One year ago tomorrow Jay Powell said we’re “a long way” from neutral interest rates. That was the cue for the stock market to crater. Which it did right until Christmas of last year.

This year’s strong performance is nothing but the market offsetting last year’s Q4 carnage.

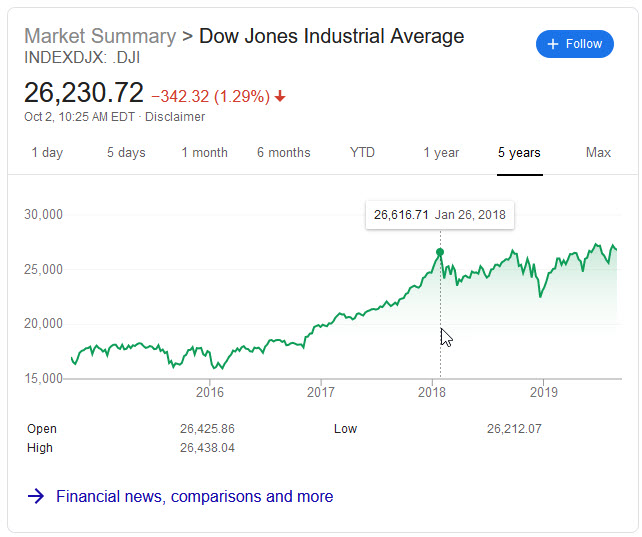

Zoom out to the beginning of 2018 and we’re flat since the January 2018 high.

This goes a long way to explain why the tax cuts absolutely did not pay for themselves. The central bank raising interest rates increased debt service costs while causing financial asset prices to collapse.

That turned out to be a losing move in terms of overall market stability.

Growth was priced to perfection until WeWork tried going to market … and that didn’t work!

We’ve had one of the biggest rotations from growth to value in the history of the market, a massive spike in oil prices on the Saudi Arabia oil refinery attack, and recent IPOs have been crapping the bed one after another.

While the index is sort of flat some rocket ship growth names have been cut in half.

- Lyft is 56% off their peak. Uber has fallen about 40%.

- Direct listings Spotify & Slack are far from their highs.

- Baidu is trading where it was in December of 2010, and there is rumors the U.S. may try to block listings of Chinese stocks on United States exchanges.

- With Beyond Meat having a market cap about 40% the size of Kroger, what’s the thesis of being long there? Maybe one needs a full load of Tilray to use while driving in their Tesla to make sense of it all.

- I like Roku & think they will benefit from marketing spend by various streaming platforms, but their 52-week range is quite extreme with a current price of $104, a recent high of $176 & a low last December of $26. Netflix is over 1/3 below their 2018 high.

The recent large rotation into value may not have been a rotation into value but rather a lifting of shorts against the sector:

Over the past few years, I have been increasingly concerned about the massive structural imbalances in the world, along with excess debt and asinine monetary policy leading to an epic equity market bubble. Remember, your investment returns are directly correlated to the price you pay, not your analytical ability and I refuse to play in the greater-fool theory of finance. … There’s been a massive VAR unwind where “momentum” gets sold and “value” gets bought—yet there aren’t actual flows into value. Rather, funds are pulling in exposure and reducing “value” shorts. While it looks like a sector rotation—I see it as a massive “risk-off” event. Vision Fund, a prominent Ponzi Scheme literally detonated overnight and destroyed confidence in all similar VC ventures. Global Crossing, Worldcom and Adelphia destroyed confidence in “new age” telecom, Tyco did it to industrials while Madoff destroyed the last vestiges of structured finance. Capital gets scarce when you cannot trust the data. Is a massive risk-parity fraud about to be exposed and complete the cycle? … the best defense against the coming crash is to not be exposed to it. … My shorts are mostly clustered in indices, though I have my fair share of exposure to Ponzi Sector stalwarts, along with a hillbilly bank exposed to Miami real estate (guess which??) and another West Coast bank exposed to Ponzi Sector fraud. I laid into Hong Kong as the country has forever been changed. I already have a lot of put exposure, but I feel like now is the time to get more aggressive and I don’t want to keep burning theta on my options. This is the first time since 2007 that I have shorted anything.

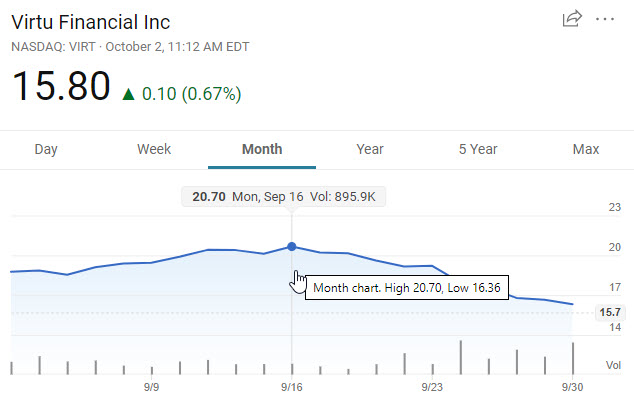

Recently there was a research note which highlighted how market stability and low trading volumes have crimped Virtu’s prospects. If Virtu specialized almost exclusively in the indexes that thesis would be correct, but many enterprise software and other hot sectors have taken a brutal beating over the past couple months. A flatish market with tons of sector rotation (due to trade headline risk, fear of recession, chaos in the Middle East, the deflationary nature of web-based software, value plays being overleveraged with debt, etc.) is likely a market where Virtu is making decent money as a market maker.

VIRT doesn’t really care what the narrative of the day is so long as the narrative regularly changes.

A couple days ago the WSJ reported about how VIRT is off 36% year to date. They’ve fallen further since.

The average number of shares traded each day in the U.S. stock market fell to 6.9 billion in the current quarter from 8.5 billion in the fourth quarter of 2018, according to a Sept. 24 research note from Sandler O’Neill + Partners. The Cboe Volatility Index—a widely watched gauge of expected U.S. stock-market volatility—fell about 25% over that period, while volumes and volatility also dropped in overseas markets

I haven’t been trading much over the past month or so, but I recently traded in and out of Virt a couple times. I am still holding a chunk of it that is down a bit, but the bits I went in-n-out were up at least a couple more grand than the chunk I am holding is off now.

Falling $5 a share for a $20 stock is a rather substantial move in a couple weeks!

I am skeptical the broader markets now, but this chop-n-grind range bound stuff with a bit of a downside bias should be a pretty fertile market environment for VIRT.

Interactive Brokers announced free stock trading which led to Charles Schwab adopting the same approach & the stock broker shares cratered, causing TD Ameritrade to announce they too would offer commission free trading. E*TRADE will also stop charging trade commissions by the end of this week.

New exchanges coming online will create more opportunities to arbitrage across markets.

New exchanges can add value to the market, but also add complexity and may make illiquid stocks harder to trade, said Tal Cohen, head of Nasdaq’s North American market services.

That is true even if the cost of accessing order flow goes up as core exchanges try to retrench.

The stock market is off nearly 2% today with volatility being up big & VIRT is roughly flat on the day. That is the market expressing a lack of faith in Virtu. They might be right, but the risk vs reward should be decent for a small position here.