Real Vision was recently profiled in the New York Times. One of their most recent interviews was Kiril Sokoloff interviewing Stanley F. Druckenmiller. In the interview Mr. Druckenmiller mentioned how health stocks drastically underperformed earlier this year perhaps in part due to political rhetoric about lowering drug prices.

He stated how it didn’t make sense they really went down then because if the economy was soft those should be some of the more stable stocks as people take their prescriptions in any economic environment. And now that it seems the economy is going better, the pharmaceutical stocks are on fire.

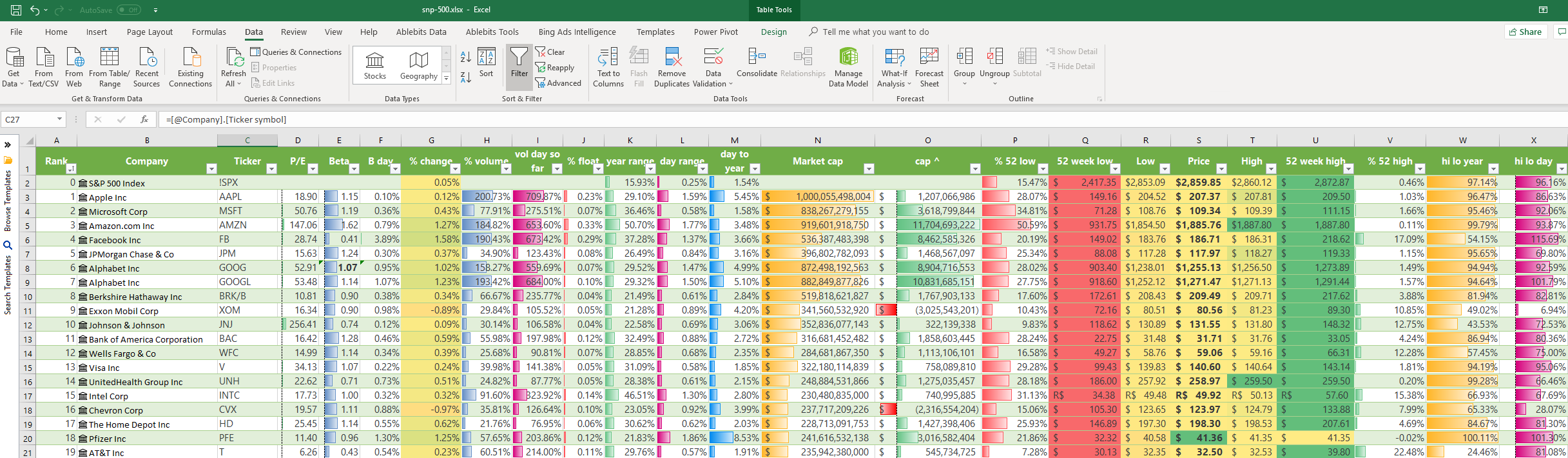

Pfizer, Abbvie, Merck, Johnson & Johnson, etc. .. you could pick just about anything and make money.

He noted how them being a hot sector right now does not perhaps make a lot of sense because the same political rhetoric is still in place.

One thing to consider is the passage of time is itself a signal. So the pharma stocks recovering from the early year swoon is the market stating they think the anti-pharma company statements from President Trump are hollow bullcrap.

One way to know of the perceived lack of importance of a particular political issue is to see how much action there is relative to jawboning. If a lot of time passes and there is still nothing but jawboning then it is a nothingburger.

Another signal that there is no drive for action is how when Trump won the election his campaign website quickly disappeared health-related promises, as noted by Karl Denninger. Mr. Denninger also wrote another blog post where he mentioned how some doctors he knew who were involved with the political process were quickly deprioritized:

If you recall I expressed grave concern during the election season that he really didn’t mean it on health reform — despite not one but three planks in his platform on the campaign web page related to same. A large part of my skepticism came from the fact that repeated inside attempts to obtain some sort of solid indication in public on the details or some sort of interaction or meeting were rebuffed.

Then, on election night, those planks disappeared. Literally gone while the votes were still being counted, as soon as the results were evident. They’ve never been seen again, although there was, during the transition, a brief flirtation through not one but two people I know (and who have impeccable credentials in terms of actual inside knowledge as a physician) with an alleged meeting on the issue. One such overture was postponed twice and then canceled with no reschedule, the second was just flat-out canceled.

So that’s at least 3 separate signals that restraining the pharmaceutical companies is political rhetoric versus political action. That would mean the market view earlier this year was wrong & the current market view is correct.

However, it is possible the market is just as incorrect today as it was during the pharmaceutical stock sell off earlier this year.

Next year the Obamacare penalty disappears. That will REALLY make the cost of healthcare hit people hard as the risk pools deteriorate. And the House of Representatives is likely to flip to being Democrat controlled after next month’s midterm elections.

When a party is sort of unopposed they can jawbone eventual changes that never come and appease their base, but when the direct consumer harm felt increases dramatically and populist party outsiders drive political discourse outside of the overture window they’ll likely end up calling each other’s bluffs & end up pushing through some sort of reform.

I recently sold out of my AbbVie & Johnson & Johnson shares on the thesis that actual change will be (almost accidentally?) forced when two different brands of fake populism are forced to square off over an issue where an increasing share of the pain is being felt directly by the populous.

With trillion dollar deficits during a non-recession, there isn’t an easy way to keep sinking an increasing share of GDP into the health industry.

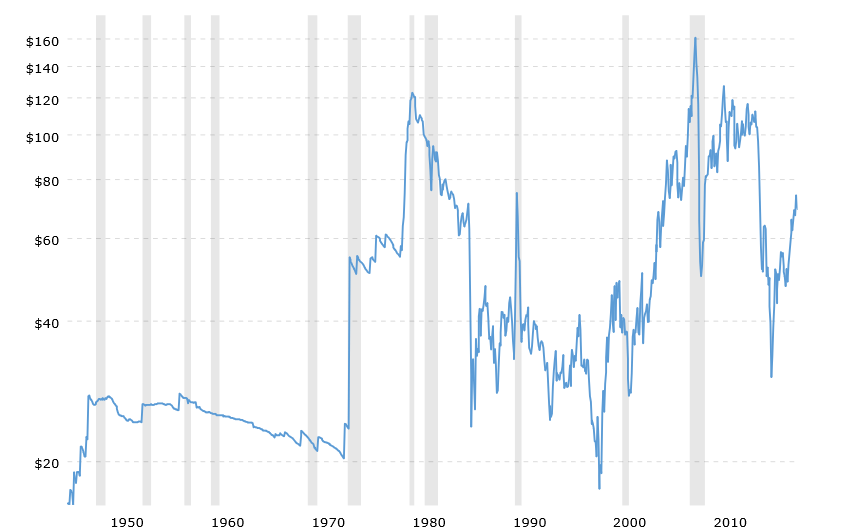

As the Federal Reserve lifted short term rates over the past couple years it didn’t carry through into longer duration bonds & there was a fear of yield curve inversion. Financials have been beaten down recently as spreads dropped.

Today longer dated bonds started selling off with the yield on the 10-year Treasury bond touching the highest level in 7 years, settling at 3.159%. The 30-year Treasury bond jumped to a 4 year high of 3.315%.

As yields rise, debt service costs rise for both the government & heavily debt-levered companies. That in turn lowers the relative value of value stocks while also increasing their interest expenses.

Once I saw bond yields jumping like that yesterday I sold off a bunch of value stocks on the thesis there will be a rotation away from them in the coming week.

Renewed confidence in the economy has helped drive bond yields to fresh highs in the second half of the year after months of relatively driftless trading.

Commerce Department data showed the economy rose at a 4.2% seasonally and inflation-adjusted annual rate in the second quarter, thanks to gains in consumer spending and business investment. Measures of consumer confidence are at 18-year highs, and corporate profits are expected to grow at a rapid clip again in the third quarter.

Accelerating growth & rising rates is typically not the sort of environment where value stocks will outperform growth. The extreme underperformance of value is likely to continue for some time unless the whole market tanks.