I’ve been (slowly) reading Ken Auletta’s book Frenemies: The Epic Disruption of the Ad Business (and Everything Else).

In the book WPP’s former head & roll up founder Martin Sorrell is regularly featured. He was consistently highlighted in the media as one of the highest paid executives in the world & even when his pay “plunged” to £13.9m that was also covered & another chance to remind how he was paid £70m in 2015.

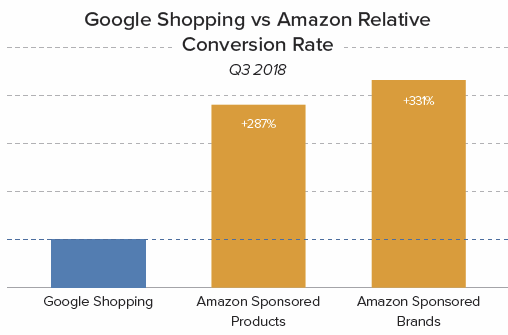

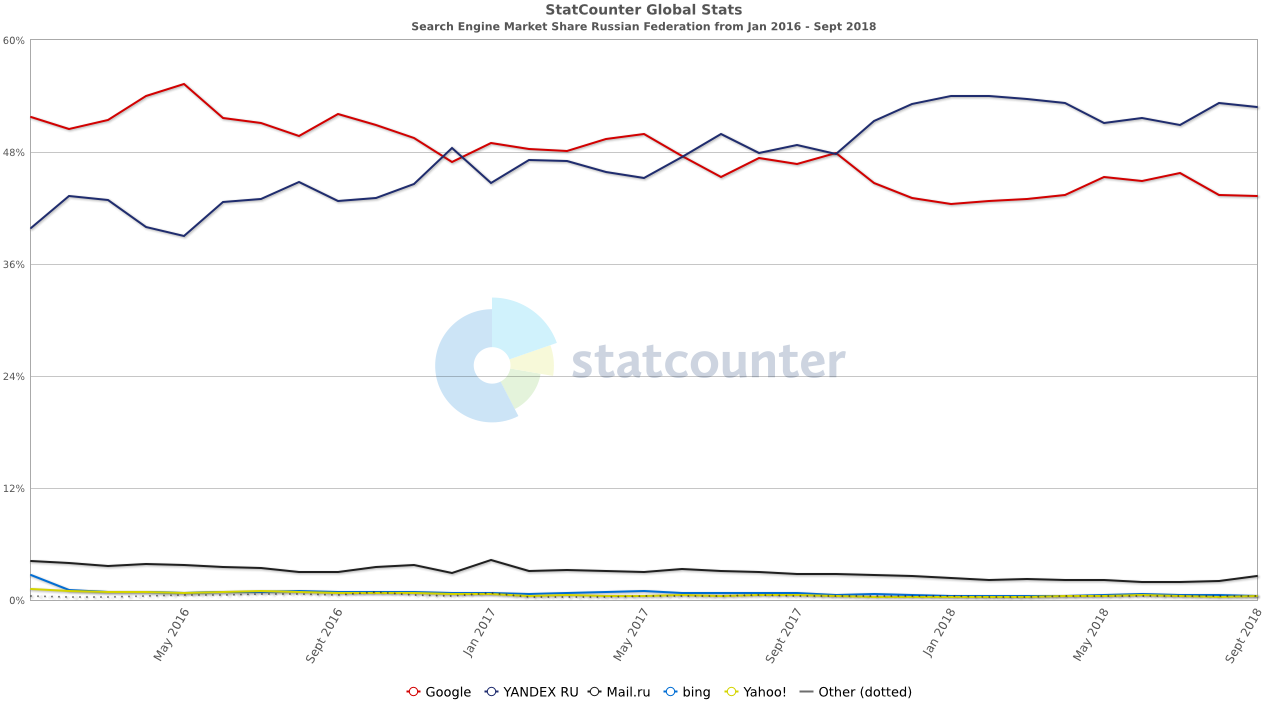

Google & Facebook have rendered the large ad agencies largely unneeded.

Large advertisers are moving their ad agnecies in house. Advertisers can use their own first party data coupled with the targeting features offered by Google & Facebook (upload email addresses, on-site user cookies, look alike audiences, etc.) to target ads more precisely than their ad agencies can.

Companies like Deloitte & Accenture have also jumped into offering marketing services.

The large ad agencies offset the rot in their core business by relying more on kickbacks on media buys, which in turn killed client trust. They also expanded margins by downsizing the various acquisitions & relying more on younger workers who are paid less than the older workers who were pushed out.

In 2009 WPP reduced their headcount by 14,000 employees. Even so, in 2017 they still have 130,000+ employees. To put that number in context, they have almost 50% more employees than Google does without all the massive “other bets” Google makes in AI, self-driving, etc. & without owning the great online real estate Google owns.

At some point when you have over 100,000 employees, the category you are in looks like it is in a death spiral, and you are largely a glorified reseller of a third party’s products & services it is hard to have a differentiated offering. Many of your brightest employees will likely jump ship and move on to Google, Facebook, Amazon, Twitter or one of the “next big thing” styled plays like Snap or Pinterest.

Many sovereign debt crises happen after a new regime comes into power. Nobody wants to be the bag holder when things fall apart. If there are many dead bodies hidden among the accounts, allowing sunlight in to highlight what has happened resets what one is viewed against by resetting the bar lower.

If a new leader says nothing then they eat it & eventually they own it. But if they reveal the corruption in the prior administration they grant themselves the authority to try to fix things along with the ability to try to change the narrative.

The same is also true with CEOs.

Looking at how frequently Martin Sorrell’s pay was highlighted, if he was doing a really crappy job he would have been fired. That his pay was covered as an outrage for so long without him being fired must have meant he was somewhat effective. However he “resigned” in April. After he resigned, it was alleged he used company money to pay for a prostitute. Of course, he denied that claim, but he was already pushed out & he was quick to launch a new venture.

Asked whether he had visited a prostitute, Sorrell said: “We’ve dealt with that by strenuously denying it.”

“So it’s not true?” Auletta asked.

“It’s not true,” Sorrell replied.

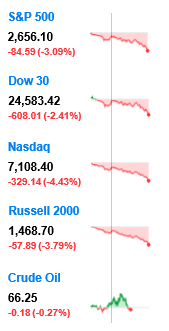

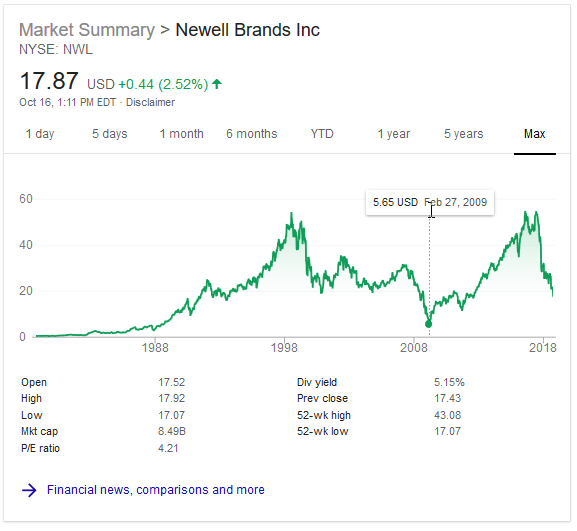

WPP shares recently fell the most in decades (worse trading day than they had in the 2008-2009 financial crisis). Revenue fell 0.8%, they missed earnings, margins declined & their share price dropped as much as 22.5% as the new CEO Mark Read has stated they’ve had trouble for the past couple years.

And here’s his money quote (re)setting the baseline

“I think any chief executive has to take responsibility for the company’s numbers. I knew the scale of the task when I took on the job and I think you have to look back in two to three years time and see how we are doing.”

At the bottom their shares fell to a six-year low.

In WPP’s biggest market, North America, like-for-like organic sales declined 5.3 percent, and there was also an unexpected slowdown in the U.K. and Western Continental Europe.

The ugliness doesn’t stop there. Now that the CEO is changing narrative & restructuring the company, the longtime CFO is also leaving.

Another Thursday announcement by the company: Chief Financial Officer Paul Richardson, who’s been in the role for 22 years, will retire in 2019.

Unfortunately 🙁 I didn’t buy put options on WPP ahead of earnings like I should have.

A reality of trading — A trader always has too much size on when wrong, too little on when right.

— Peter Brandt (@PeterLBrandt) October 22, 2018

It was such an obvious change given the Sorrell story, the new CEO & the disruption in their core market

Traders do not find good trades — good trades find traders. The best trades are self-evident.

— Peter Brandt (@PeterLBrandt) October 24, 2018

Some things are so obvious we look right past them. Doah!