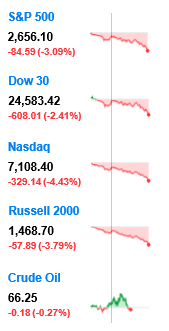

Trading yesterday certainly felt like picking up nickels in front of a steamroller.

Of the Nasdaq 100, a few minutes before close the only 3 stocks that were up were overrun / off sized clothing discounter Ross Stores & then food product companies Pepsi & Mondelez International which help give bodies an irregular size so they will fit the clothing for sale in Ross Stores.

By end of day Ross Stores went negative, so my joke (acknowledging I am more than a little bit chubby) was for the most part ruined.

I once again sold a bit of Yandex at open.

As ugly as their chart has been the past week, buying the close and selling the open keeps being a winning move.

By the end of day yesterday, I didn’t want to put any more positions on, so I won’t be testing ye ole Yandex fliperoo this morning.

When the markets turned up yesterday I went in & out of eBay, sold off a bit of the AT&T I bought during the morning plunge (though am still holding a bit) & bought a little more AbbVie & Google.

The quick flips were good, but the broader market upturn was fake as in news. When I came back from my workout…look out below!

Bing ad revenues were up 17% YoY. I am sure Google grew faster. Merkle’s 2018 Q3 DMR report stated advertisers increased YouTube spending 77% YoY.

The big issue for Google is the giant TAC payments to Apple for default search placement on iOS devices & desktop Safari web browser.

Google could pay Apple $9 billion in 2018, and $12 billion in 2019, according to the Goldman estimate. … In 2017, Bernstein analyst Toni Sacconaghi estimated that Google was paying Apple $3 billion per year. The only hard number we know for sure is that Google paid Apple $1 billion in 2014, thanks to court filings.

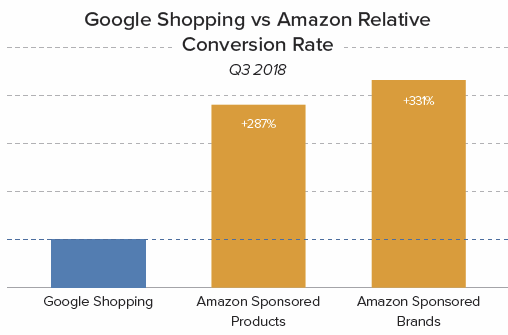

According to Merkle’s Q3 DMR report Amazon’s product ads are dusting Google on the conversion rate.

This is likely due to some combination of

- far higher conversion rates for Amazon on mobile with 1-click ordering

- trust in Amazon’s logistics network

- Google’s disdain for customer service

- the perception that Amazon is a destination store & a brand aligned with ecommerce, whereas Google Shopping is to ecommerce as Google Video was to video.

That gap will only expand over time as more & more web usage is mobile or even voice.

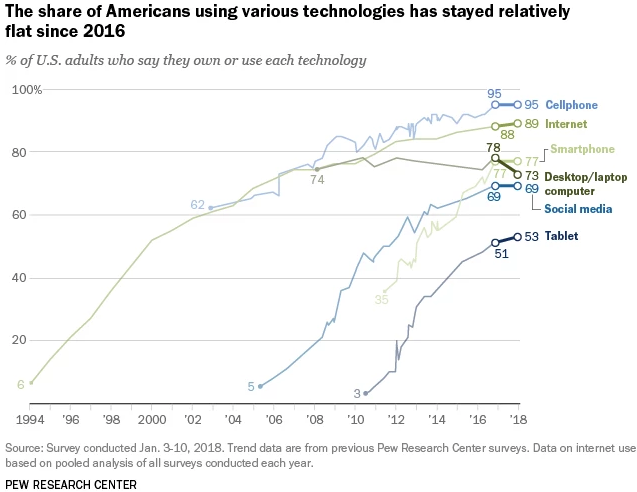

As a person who works at home it is easy to underestimate how massive mobile web usage is, but people who are having their desktop computers die are in many cases not even replacing them (and that is during a non-recession).

The headline on this graph is fairly muted, but look at the 5% slide on desktop & laptop usage in 2 years.

With the rise of Roku, Chromecast, Amazon Fire Stick, Apple TV, Netflix, Hulu, etc. … for many people the web is simply becoming on-demand TV. Most other simple tasks like email & social media can be done over mobile.

A big portion of the delta is a lot of the Amazon clicks are brand arbitrage where brands feel the need to bid to displace competitors on own brand terms. Google, of course, also enjoys immense profits from brand arbitrage, but they are seen as a search engine rather than a product search ecommerce platform, which makes it harder for them to offer a single stand out massive ad unit for the top bidder the way Amazon can.

Brands feel the need to bid aggressively on Amazon to block counterfeits, cheap goods manufactured from China & the Amazon private label brands showing up everywhere.

One could almost view Amazon’s private label brands as their version of the knowledge graph & people also ask features in Google results. Visual noise to distract users and force the ad buy. Most users are unaware of how extreme it has become, but those who get the web get pissed at the practice.

Ultimately Google will need a real, distinct & separate brand for ecommerce. Their ecommerce equivalent to YouTube.

While eBay keeps sliding (just like Yandex) I think eBay will eventually be a good take out target. They’d be a great way for Walmart to juice their ecommerce business. And if Google or Facebook decide to move away from / compliment their ad revenues from CPC click ads & video watch ads then eBay is a great way to buy a big chunk of the market & own a destination site.

I could also see a company like Wayfair acquiring Overstock to expand their perceived addressable market. But the move down market is really that big. Amazon is a giant, eBay is large but somewhat stagnant, Walmart & Target are aggressively investing in e-commerce, but then if you go below that layer in the US you are really talking niche brands like Blue Nile or Wayfair or companies that are sort of running in reverse (in terms of growth) like Overstock.

Pre-market the S&P 500, Dow Jones Industrial Average & Nasdaq are all up big.

I spent much of the last month doing mostly trades I was going in & out of on the same day, or lightening positions particularly on winners. I am mostly in cash as I expect heightened volatility at least until the midterm elections are over. Daily pipe bomb stories (real or fake) tend to help the news media sell the fear.

And there are many knock on effects beyond interest rates & investor preference for growth vs value equities vs various qualities fixed income. As Netflix levers up on debt & slides, lowered faith in their model not only hits their stock price, but it also causes Disney to slide since the soon to be added on complimentary revenue stream for Disney

If it looks like a duck……#NFLX returns are identical to Shanghai Composite into its 2015 bubble high. If the pattern holds the stock will be 50% lower by next spring….its a duck! pic.twitter.com/WxO8iKd5yR

— Julian Brigden (@JulianMI2) October 24, 2018

Arguably if Netflix weakens & can’t spend as much on differentiating content it would make Disney a stronger competitor that grows share even faster, particularly with all their fantastic IP they own.

Of course short-term & long-term narratives can run in opposing directions & the market is largely viewing Disneyflix as a wait and see.

There’s still the war of the roses between Trump & Xi, and the war of the roses 2 between Trump & Powell.

Some savvy voices in macro think the Federal reserve has already overtightened too quickly to where yield on longer duration bonds are going to start dropping significantly.

I'm so bullish US Fixed income (as I believe the Fed have over tightened), that I cant see straight! Im long 10 yrs, 2's 10's YC steepener, the 1yr 2yr flattener (think it inverts) and long EDZ0… trying to stop myself adding 30's and 2's outright too…

— Raoul Pal (@RaoulGMI) October 24, 2018

In the January/February sell off bonds were down with equities, whereas during yesterday’s broad-based market plunge longer duration bonds strengthened.