You Have to be Awake to be in the Game

Once again Yandex was up big on open, cratered, and then recovered a bit.

A big part of day trading is being awake during the trading day. 🙂

I screwed up my back and my sleep so I didn’t catch open, though thankfully am feeling a bit better now. I woke up right as the stock was bottoming and didn’t have my mind set to be able to trade then.

Yandex News

Yandex’s founder Arkady Volozh has a significant voting share in the company & put out a statement he had no interest in selling his stake.

Two other notes about Yandex.

First, as of their February report their US-based shares are largely held by a single entity:

Yandex said that as of Feb. 15, 2018, there was one holder of its shares based in the United States which held almost all Class A shares, or around 42.10 percent of shares by voting rights. It did not disclose the name.

Second, Russia has a draft law which will limit foreign ownership in news aggregators.

Russian-language news aggregators Google and Yandex will fall under the draft law limiting participation of foreigners in news aggregators ownership structure, submitted to the State Duma on Monday, co-author of the initiative and State Duma representative Anton Gorelkin told TASS on Monday.

In theory, if such a law were passed it would hit Google harder than Yandex in the Russian market, as Google would either be forced to create a separate operating entity for their Russian news search, or they would have to shut down their news search vertical.

If that law were passed Yandex could rebuy some of their shares and/or sell an equity stake to a local business (like Sberbank) to get the foreign ownership level below 20%.

If Google creates a separate operating entity in Russia that will play absolutely horribly with the polarized political conversation in the United States. Which would mean they would likely be forced to abandon the news vertical, which would then likely cause Yandex’s service to be more differentiated & help Yandex further gain search marketshare across Russia.

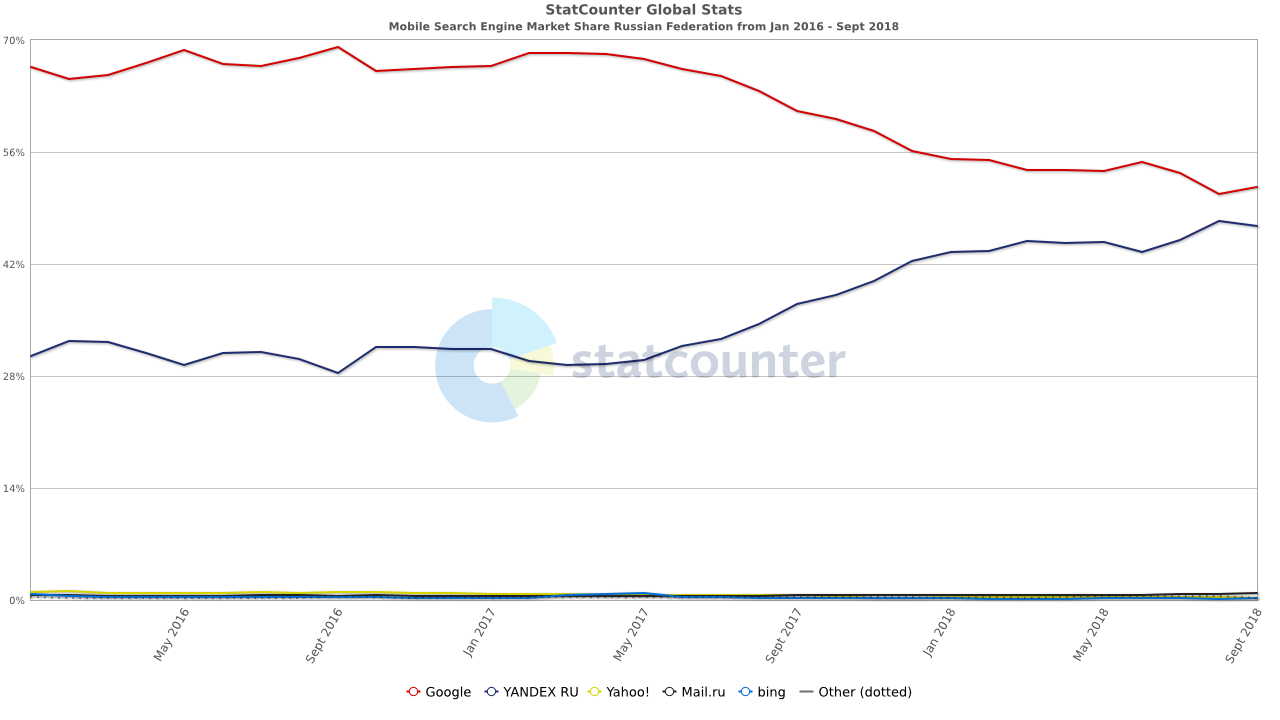

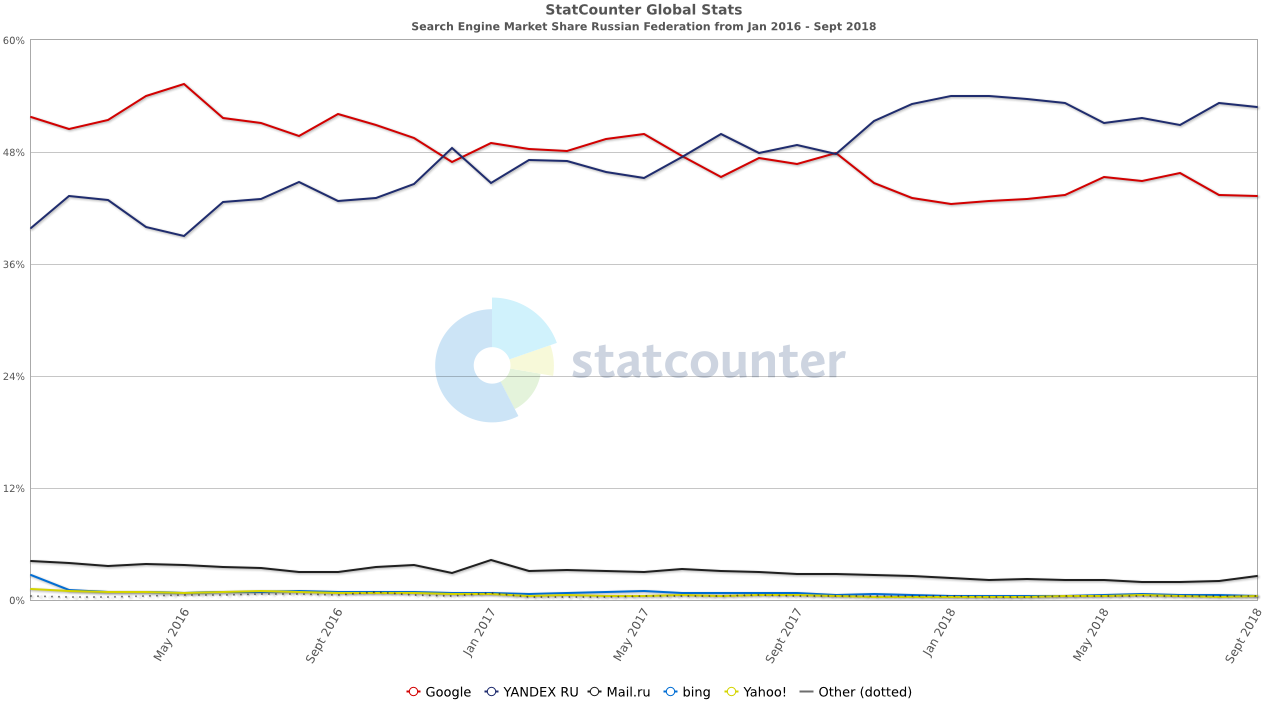

Russia was the first market to fine Google for their Android bundling. Since then Yandex has dramatically closed the gap with Google on mobile search usage, lowering the usage gap from 36% to 5%.

And Yandex still leads on desktop + overall.

If Google lacks local news coverage then Yandex could in short order end up with perhaps 70% to even 75% of the Russian search marketshare. That would grow Yandex search revenues at least 25% on top of the general growth of search usage & search ad click prices.

Longterm the above should make Yandex a buy, however there still are 3 big issues:

- If the news aggregation regulation passes will Yandex spin out a separate news subsidiary? Or will foreign ownership need to be reduced?

- It is in Russia. Is the company going to come under state control & get plundered?

- If a single US shareholder owned a large stake in the company is the current massive selling over the past 3 trading days that entity being forced to lower its stake?

Yahoo! Finance lists the following holders information.

Major Holders

Currency in USD

Breakdown

| 3.57% | % of Shares Held by All Insider |

| 83.95% | % of Shares Held by Institutions |

| 87.06% | % of Float Held by Institutions |

| 423 | Number of Institutions Holding Shares |

Top Institutional Holders

| Holder | Shares | Date Reported | % Out | Value |

|---|---|---|---|---|

| Wellington Management Company, LLP | 14,742,445 | Jun 29, 2018 | 5.08% | 509,351,463 |

| FMR, LLC | 11,880,500 | Jun 29, 2018 | 4.09% | 410,471,265 |

| Capital Research Global Investors | 9,238,886 | Jun 29, 2018 | 3.18% | 319,203,504 |

| Oppenheimer Funds, Inc. | 8,924,602 | Jun 29, 2018 | 3.07% | 308,344,992 |

| Carmignac Gestion | 8,543,751 | Jun 29, 2018 | 2.94% | 295,186,590 |

| Morgan Stanley | 6,197,172 | Jun 29, 2018 | 2.13% | 214,112,287 |

| Blackrock Inc. | 6,161,700 | Jun 29, 2018 | 2.12% | 212,886,730 |

| Melvin Capital Management LP | 5,754,408 | Jun 29, 2018 | 1.98% | 198,814,792 |

| Wells Fargo & Company | 5,426,630 | Jun 29, 2018 | 1.87% | 187,490,062 |

| Harding Loevner LLC | 4,722,149 | Jun 29, 2018 | 1.63% | 163,150,244 |

Top Mutual Fund Holders

| Holder | Shares | Date Reported | % Out | Value |

|---|---|---|---|---|

| Fidelity Series Emerging Markets Opportunities Fund | 4,644,580 | Jun 29, 2018 | 1.60% | 160,470,235 |

| Invesco Developing Markets Fund | 2,592,126 | Jun 29, 2018 | 0.89% | 89,557,951 |

| VanEck Vectors ETF Tr-Russia ETF | 2,068,048 | Jun 29, 2018 | 0.71% | 71,451,056 |

| Baron Emerging Markets Fund | 2,019,815 | Dec 30, 2017 | 0.70% | 65,765,179 |

| Price (T.Rowe) Emerging Markets Stock Fund | 1,668,630 | Jun 29, 2018 | 0.57% | 57,651,165 |

| Smallcap World Fund | 1,530,000 | Mar 30, 2018 | 0.53% | 60,052,500 |

| Vanguard International Value Fund | 1,381,815 | Jan 30, 2018 | 0.48% | 53,199,877 |

| Artisan Developing World Fund | 1,329,473 | Dec 30, 2017 | 0.46% | 43,287,642 |

| Ivy Emerging Markets Equity Fund | 1,283,000 | Dec 30, 2017 | 0.44% | 41,774,481 |

| Wells Fargo Emerging Markets Equity Fd | 1,240,106 | Jun 29, 2018 | 0.43% | 42,845,661 |

Nationalism / Re-localizing The Internet Supply Chains

President Trump is given a lot of crap for being “nationalistic” but so many other leaders around the world are approaching the web using the nationalistic playbook…

- It is hard to find a more nationalistic country in terms of tech ecosystem than China is. Outside of the US there are only a couple mega cap tech companies that are not from China. And China is trying to force sharing of source code as a condition for market access.

- Eric Schmidt has suggested the web will fracture with there being the Chinese Internet & the other Internet.

- Look at the hoops Google is trying to jump through to get back into the Chinese market. And once they state they are willing to do X (censorship, tracking users, passing information onto a local partner who will then pass it on to the CCP) to be in China they’ve established they are willing to do X, so other countries will ask the same.

- the EU passed GDPR along with regulations requiring streaming services to have a set percent of local content. And they have the laws surrounding things like compulsory copyright / link tax.

- Vietnam is following China in requiring localized data storage.

- India requires ecommerce platforms that sell third party brands to sell for local merchants rather than carrying inventory directly

- Inda passed a law requiring payment data to be stored locally (which was likely a big part of why Berkshire Hathaway invested in Paytm’s parent company).

Other Trades

Funko was up big today (10.21%, closing the day at $20.08), so I sold out my remaining share in it. If it slides tomorrow I will re-establish a position.

I sold out a bit of TCEHY I was holding for a while at a small loss. Last Thursday I bought a small amount that I sold at a gain Friday, so these two trades just about offset.

This afternoon I also went in and out of ABBV, AEM & EBAY for small gains. I picked up a bit more ABBV just before close.