Investing is managing risk as a cost of entry:

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder and you deserve the mediocre result you’re going to get.”

Charlie Munger

When a narrative of major risk arrives active managers sell off the associated stocks, as he who acts last loses. This is true in almost every case unless

- the risk turns out to be a nothingburger which is vastly over-exaggerated, and

- the holder does not exit their position after the initial reaction

Even if you know the risk narrative is junk, it will still ultimately impact short term stock price as other investors reposition. If you are smarter than the market you still lose if you have a mismatched timeline on a position. Early is no different than wrong unless you have the ability to endure.

Take healthcare recently. One could have saw how a top Nancy Pelosi aid was promising good things for health insurance lobbyists while also being aware of how President Trump has done virtually nothing to reign in healthcare spending costs & dropped some of his campaign promises on the issue the day he was elected. Other than dropping the individual mandate driven Obamacare policy there hasn’t been any major upgrades in terms of improving healthcare cost & efficiency.

In spite of the above, political rhetoric from the fringe end of the left promising socialized medicine scared the shit out of investors who owned a significant stake in health insurance companies. Then there were other pile on issues as Trump half-heartedly pushed through “reform” agenda talking points on drug care pricing and rebates.

When the White House announced they were killing the rebate idea CVS opened up about 7.5% while Cigna was up 14%. That is the sort of move a stock might get when a risk event disappears on the most favorable terms possible.

If you have some dogs in your portfolio & get hit by a black swan that nobody saw coming that can be seen as a bad break, but sitting on a big loser when the risk narrative has been in the press regularly for months on end puts an investment manager in the awkward position of explaining why they are down so much on a position when the media made it clear the risk was both large & known.

You can be right about the eventual outcome & still lose capital under management as a dog pulls down the aggregate performance.

Each additional media story has the potential to create another wave of selling. Each story drives demand for additional follow ups, causing more reporters to probe for angles.

When the risk event is solved, the sort of catastrophic downside disappears, so the uncertainty being removed causes the stock to jump because the issue is now solve & there is no longer the toxic narrative associated with it.

Shortly before close the FTC announced they were finalizing their Facebook settlement and – as expected – the stock rose on the story of the risk event going away. Tech bloggers who do not understand the capital markets are complaining about the stock going up as proof the fine was an embarrassing joke.

Facebook telegraphed the potential fine long ago & their initial whisper number on the expected fine turned out to be what the finalized number was. If the information they conveyed along the way was vastly off then the story would not be over, as the stock likely would have slid if the penalty was far larger than expected & that would have been followed up by shareholder lawsuits from shareholders who suffered losses.

There’s a limit to how heavily U.S. regulators can fine domestic tech companies for egregious behavior while simultaneously threatening France & the U.K. about potential blowback for clipping U.S. tech companies (while thumbing the eye of Germany for good measure).

“The United States is very concerned that the digital services tax which is expected to pass the French Senate tomorrow unfairly targets American companies,” Mr. Lighthizer said in a statement. “The President has directed that we investigate the effects of this legislation and determine whether it is discriminatory or unreasonable and burdens or restricts United States commerce.”

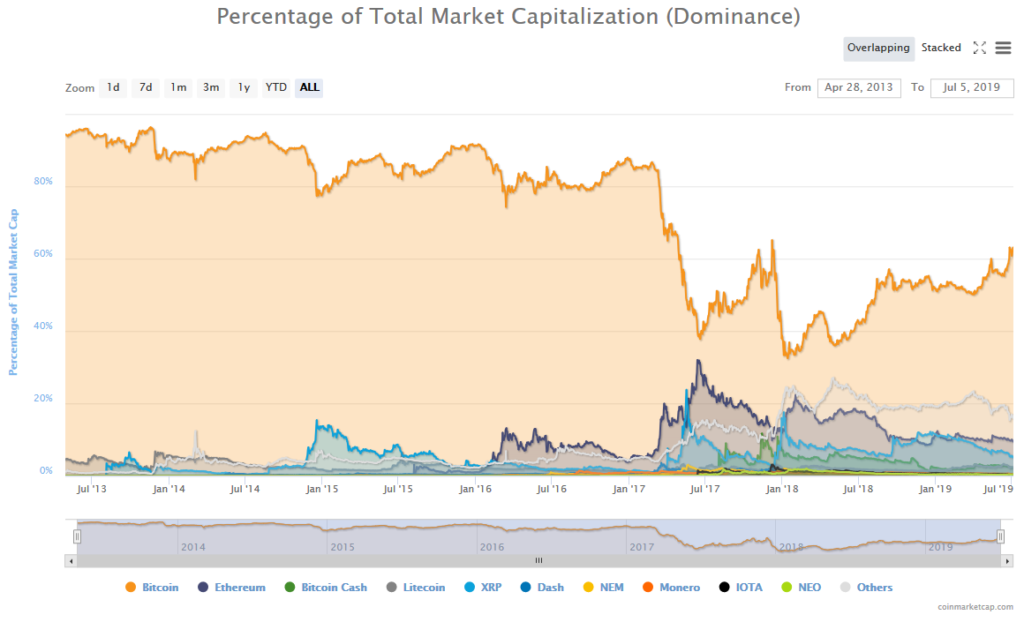

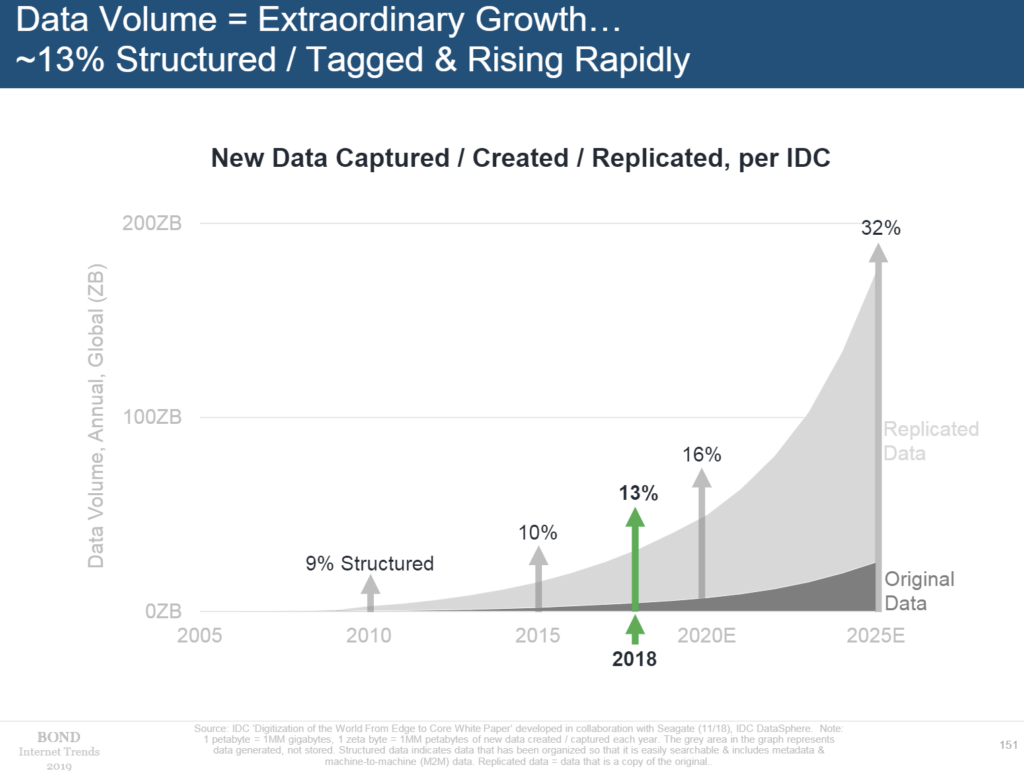

The domestic tech companies created the fabric of the web & are perhaps even a big part of the draw for investor capital flows into the currency:

“globalization is ending and the world is breaking into three separate economic zones with their own (i) trade and reserve currency, (ii) bond market of reference and, perhaps most importantly, (iii) dedicated supply chains. … China’s vulnerability stems from semiconductors being its biggest import item (about US$260bn a year against energy’s US$170bn) and that US semiproducers hold most of the world’s important patents. … Looking past current tensions, US tech stocks are threatened by the US-China standoff becoming a full-scale cold war. First, this would devastate supply chains, with major consequences for productivity and profitability. The second, and more alarming prospect, is that the breakdown in relations worsens to an extent that China’s policymakers conclude they have no interest in respecting intellectual property rights. After all, if we move into a world where Chinese exports into the US, and other developed world countries, become constrained, China may decide to forgo those markets. It could instead focus on reverse-engineering Western products like jet engines and medical devices with a view to selling them into emerging markets. … Perhaps the utter domination of US tech has not only triggered the massive outperformance of US equity markets, but has also helped keep the dollar high in spite of the US’s sustained twin deficits.”

This might have been a big piece of why the U.S. was so slow to regulate the likes of Google & Facebook.

Facebook also could have been slowed down in 2012, particularly in regard to its purchase of rival social media site Instagram. The FTC had the ability to file a lawsuit to block that merger, and considered doing so. During the investigation, the agency uncovered a document written by a high-level Facebook executive (no name is given). According to the New York Post, the executive said bluntly that Facebook was buying Instagram to eliminate a competitor. One source called it a “spectacular” document.

Externalities were seen largely as bullshit, sour grapes, or complaints from irrelevant dinosaurs who were technology passed by. It took the election of Donald Trump to give the dominant platforms the appropriate level of scrutiny they deserved:

“The Palo Alto Consensus held that American-made internet communication technologies (both hardware and software) should be distributed globally and that governments should be discouraged from restricting speech online. Its proponents believed that states in which public discourse was governed by “everyone” — via social media and the internet — would become more democratic. This would mean both regime change in authoritarian countries (the Arab Spring) and more responsive politics in electoral democracies (something like the White House Petitions). … We can now evaluate how this technology affects politics and the public sphere. More information has been flowing, circumventing traditional media, political and cultural establishments. But the result hasn’t been more democracy, stronger communities or a world that’s closer together. Countries with weaker social institutions felt the effects of social media most violently and immediately. … If the West had supplied basic internet technology and allowed local, domestic competition, social media would be more diverse and more culturally sensitive than it is today. That diversity would give scholars and policymakers a variety of concurrent experiments. The Palo Alto Consensus entailed running the same yearslong experiment in dozens of countries.”

Stocks are a leveraged long on a market, thesis & company. So long as the central banks keep pushing liquidity into the markets, then financial asset prices are likely to remain elevated versus historical prices. But if you are a contrarian & have patient capital that can stand a bit of pain, investing in risk event overreactions is a great way to have capital in the market with some of the downside price already taken out of it. It is important to keep position sizes small enough that you can keep capital in the position even after reading near daily stories about how the stock is a dog, anyone who owns it is an idiot, etc.

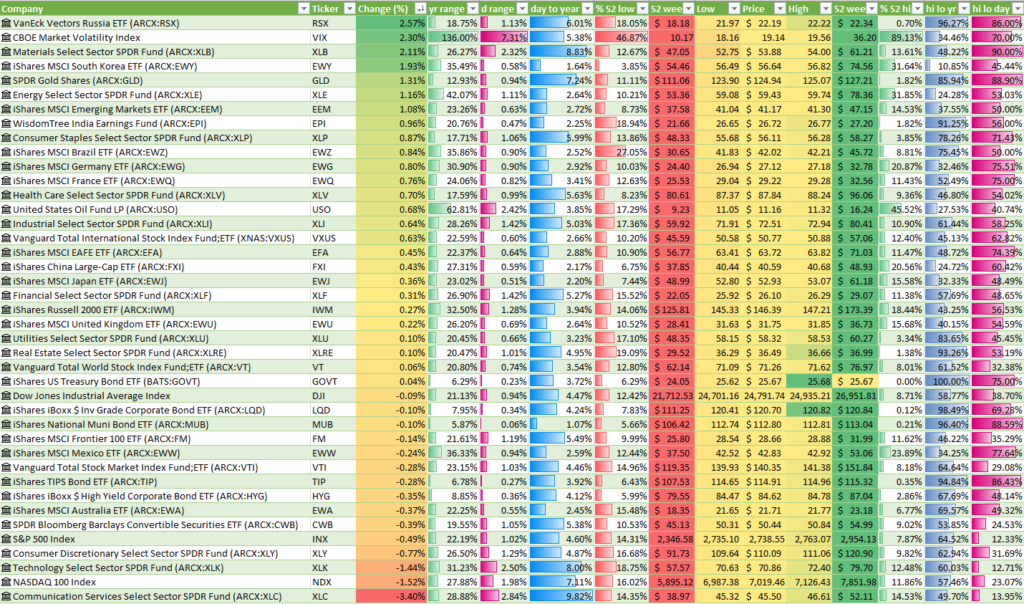

Many trends in the capital market tend to remain in place well past their logical conclusion, until they are so far past rational that they violently break in the other direction.

As Tom Sosnoff states, volatility is mean reverting but price is not.

It matters how big the risk event turns out to be versus what is perceived / priced in. When risk is perceived to be extremely high, much of the potential downside has already been removed.

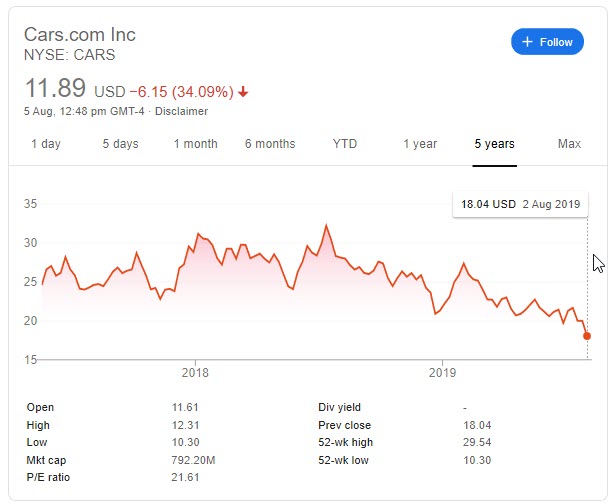

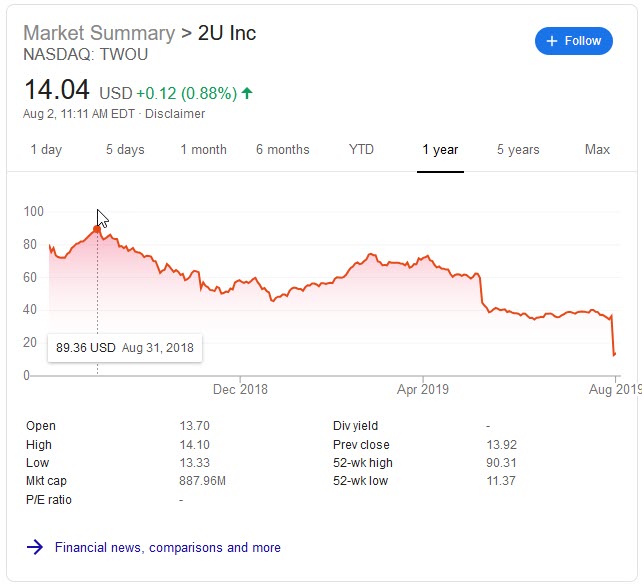

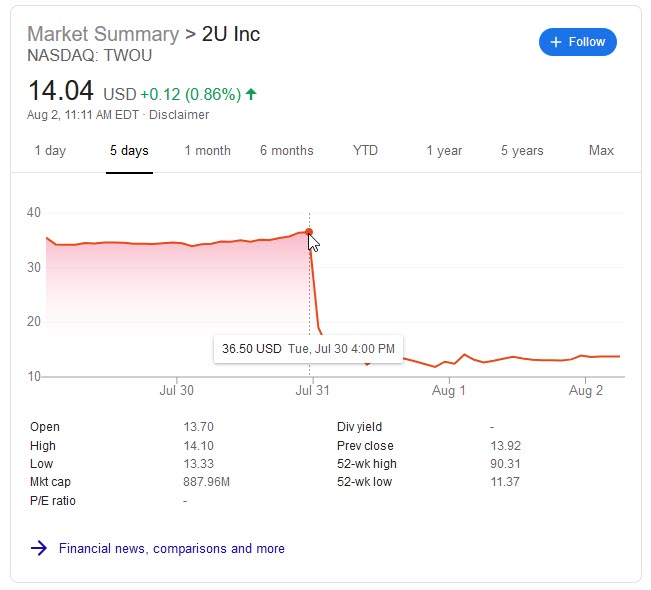

Some risks are temporary and/or cyclical. Others are structural.

Going private doesn’t eliminate shareholders, but rather leaves CEOs facing a handful of more powerful ones, Mr. Questrom said. He noted that it is possible to invest for the long term as a public company and be rewarded for those actions by shareholders, as is the case with Walmart Inc. and Target Corp. “The companies whose stocks are down are doing a lousy job of running their business,” he said.

The delineation there (along with the debt servicing costs of the entity in the market) are often the difference between stocks that eventually mean revert back up to historical valuation metrics (e.g. P/S P/E etc.) & those which become absolute zeros or get acquired by someone else on their way to zero.

If a stock gets acquired before the company goes under that acquisition locks in an exit price for existing shareholders, though it might create a compelling buying opportunity in either the acquirer’s stock or the stock of the company being acquired.

Bloomberg recently conducted an interesting interview of Research Affiliates founder Rob Arnott. He mentions many contrarian value ideas like investing in emerging market value stocks, embracing maverick risk, preferring European stocks to US stocks at current prices, stocks which are removed from indexes like the S&P 500 outperforming stocks that are added to the index, reducing rates to near zero or below zero ends up being counterproductive as it signals panic, and a host of other similarly interesting tidbits.