Late last year when the market imploded Funko slid hard. They went from an all time high of $31.12 a share down to $11.22 a share. Over the past couple months they started to recover again with the broader stock market, and have touched $25.

When the market was up big on the narrative that trade talks would resume (did they ever actually stop?) Funko was off about 12% on a day when just about everything was up.

Seeing that divergence, I put a chunk of change from my IRA into Funko only to see the stock quickly bottom & fly up about 6%.

I intended to hold it longer, but if you get 6% in an afternoon, there’s no shame in exiting & waiting another entry.

And, as it turns out, looks like that was a good call, as FNKO has slid for a couple days now.

Of course it could jump at open, but I suspect there will be many more opportunities to go in and out of Funko.

If you were going to try to put a lot of money to work Funko would be a horrible investment vehicle, because even small trades can move the stock price a dime a share sometimes. That’s a big move on a stock trading at around $20 a share.

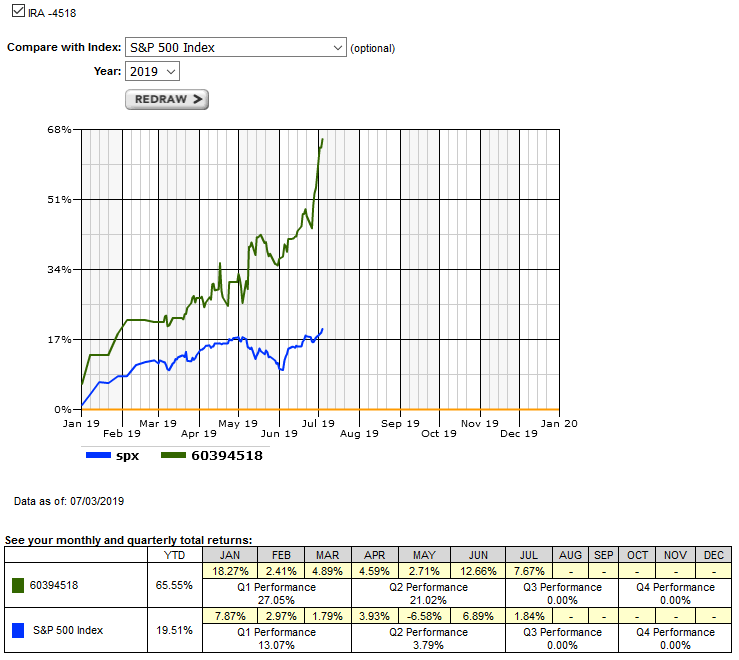

This year I’ve done well in my IRA because I have mostly done rather high conviction trades & made them rather concentrated.

I have been in cash most days, but you really only need to catch a few of those 3% or 5% moves to have a solid month.

But my IRA is so small as to be meaningless, so it isn’t really going to move the markets & it is easy to aggressively invest it without being too emotionally impacted because the sums are so tiny. (I was stupidly poor for a long time & then went to where I made too much to invest in a traditional IRA, I should set up another retirement account that I can deposit some savings into though).

My main trading account has only done a fraction of what the market has returned, in part because I have mostly stayed in lower beta value trap garbage & even a big chunk of it is in cash, just in case the market totally melts down…I wouldn’t want to see a 2008 repeat having $20ish FNKO hitting about $4 a share & then a management-led buyout that locks me in at the bottom.

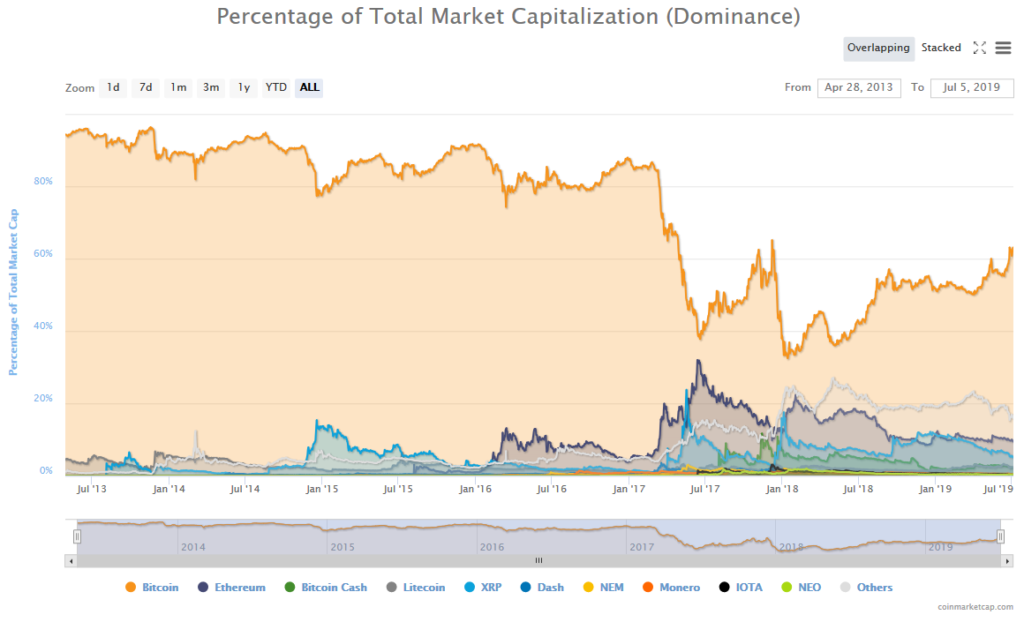

I sold out the last of my Bitcoin on the 26th of June, with it nearly doubling from what I paid for it last year. I then bought back in at just above 10k & sold the following day for a quick 6ish percent gain. I think Bitcoin ran too far, too fast & we are likely to see $6k before we see $16k. If it goes back around $7k or $8k I might buy a bit more of it, though it could fall even lower than that as lawmakers & regulators dig into Facebook’s Libra project & what was once a catalyst becomes a headwind.

One other interesting thing to note is in spite of all the various alt coin hype, this recovery has largely left the alternatives behind. In July of 2017 it looked as though Ethereum could eclipse Bitcoin, but it hasn’t seen the same upward momentum recently.

This is a good video about cryptocurrencies.

I still think the trade war stuff is absolutely over-hyped at each extreme. Now that we are near record highs on fake progress it might make sense to lighten up exposure waiting for a narrative shift. Overall I am over 90% cash, though I could quickly invest if I saw a great opportunity.

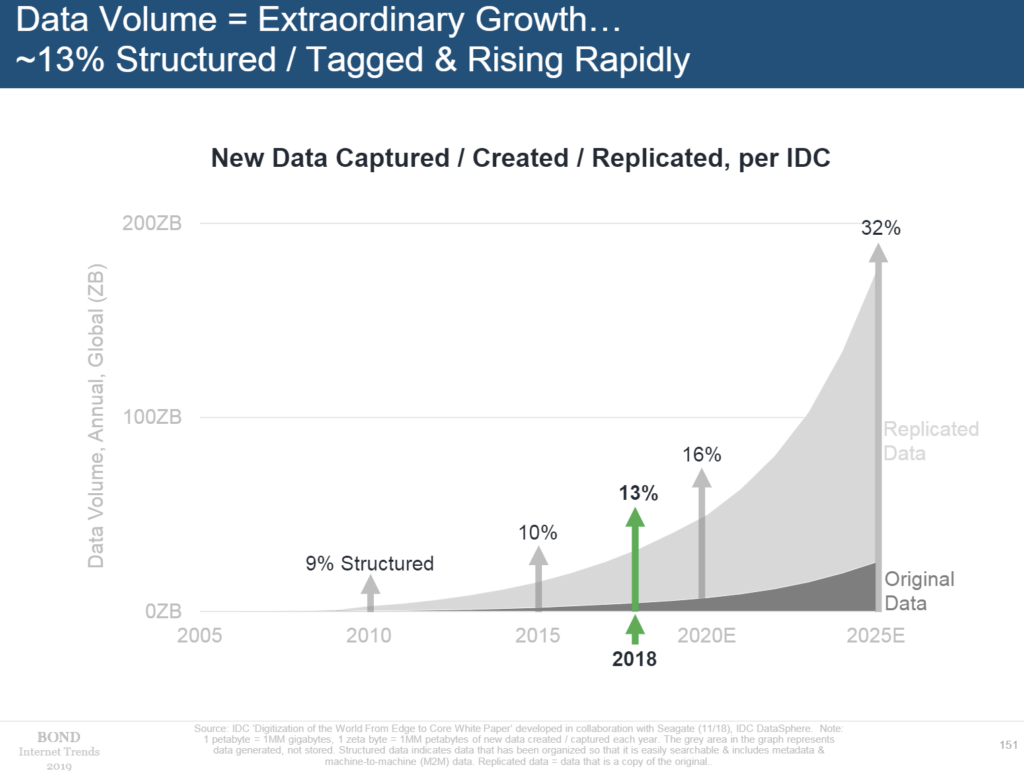

One opportunity which was snatching defeat from the jaws of victory was quickly exiting Seagate & Western Digital. I bought both of them near recently lows and they’ve went up relentlessly since I sold. My narrative/idea on those is pretty basic though…they sell for 1x to 2x sales, do not have a ton of competition, and the amount of data being created every year is still increasing geometrically. Even data that is stored in the cloud is usually stored on hard drives because the data is often backed up/replicated at multiple locations and hard drives are so much cheaper per gig than solid state drives, RAM, or any other form of storage.

Hard drive stocks sold off with semiconductor stocks, but we’ll still need far more hard drives every year even if RAM demand & margins go through a soft patch.