Yesterday stocks like FNKO & PETS were both up huge (around 7%). I sold off the PETS I had in my IRA & a bit of the PETS I had in my regular trading account yesterday. Today PETS ramped again & I sold down another 2/3 of what I had left in my regular trading account today. I still have a small position, but am sort of hoping the stock falls so I can reload.

The PETS stock was incredibly ugly over the past month or so. It has pulled back with CVET and CHWY, except much more aggressively. I bought the bottom almost to the penny in my IRA.

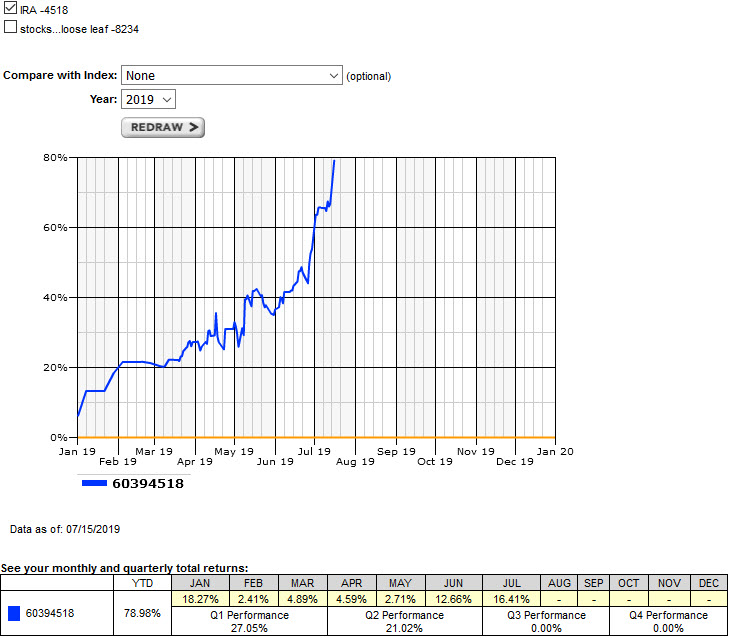

The growth chart on that thing this year almost looks like an alt coin ponzi deal, except the performance is real. Only crappy bit is I don’t have too much money in the IRA, though a few more years like this one & it would no longer be the case. 😀

Some investors thought the launch of CHWY meant there was no narrative to justify pouring capital into PETS.

Perhaps that would be true if both were profit making, had capital savings & paid a hefty dividend, but only one of the two names is doing that. And then the other has massive profitless growth.

The last 2 days have seen PETS up over 10% with yesterday’s trading volume over double the typical day.

The recent PETS performance has been far uglier than shown in that chart, as they’ve fallen from a high of $54 on January 16, 2018 & are now “up” to $16.97 a share. I believe their cash on hand & inventory is around $6 per share as well, so that fall was really like a company careening toward bankruptcy unable to meet their debt service obligations when in fact they have no debt & about a third of their market cap is cash or inventory.

Covetrus (CVET) has had a similarly ugly performance, sliding from an IPO price of around $46 down to $25.47 today. That’s quite an achievement considering they IPOed back in early February & how strong the stock market has been this year.

They lack growth & they might eventually be priced out of maintaining online exposure in their category if their competitor selling a broader line has a higher visitor value, better brand recognition that makes ad bid prices cheaper based on brand recognition, and the capital markets do not demand profits from Chewy.

But the price action over the last couple days is almost like someone is establishing a position in PETS before acquiring it, or with intent to drive management to make strategic decisions that reward the big financial arbitragers (e.g. sell itself, offer a one-time dividend, etc.).

PETS reports earnings in a week – on the 22nd. I don’t want to have a huge position going into earnings, but if they bomb another one & the stock fades again I think a financier pushing strategic options could emerge. Their small market cap of about 1/3 billion probably makes the below the radar of a Carl Icahn, but smaller investors could build up a sizable position in the company without having to spend too much.

There have recently been headlines like Pet care is a recession-proof industry, with part of the Chewy IPO roadshow material being recycled into new insights.

The media loves rewriting that story.

The speed of the recent rise has me wanting to have at least a bit of exposure to the stock, but a limited sized one with most the gains locked in already.

My IRA is now all in cash and my main trading account is about 2/3 cash. I exited the CVS position on the short squeeze on the drug rebate news, as I expected the broader doom & gloom of politics would outweigh that temporary reprieve.

That said, CVS has held up better than some others like Cardinal Health that now find themselves trading below where they were when the White House rebates health announcement was made.

I still have small positions in Apple & Disney that I don’t really count because they are in Robinhood & I rarely look at it (for me the idea of trading on a mobile device puts one too close to doing like impulse gambling rather than informed investing or even semi-informed speculation).

I am holding a bit of Walgreens that is still down, though it looks like they may soon refresh some of their product line, at least at the Philadelphia store. Items were literally flying off the shelves in a recent flash rob where dozens of teens looted the joint.

I also have a bit of SKT, which is off bigly, though has a decent dividend.

And I still have a bit of PETS. And then I have a bit of Kroger. I think eventually the narrative will change on KR like it did for Walmart & Target, causing a re-rating of KR’s performance & growth prospects.

Kroger, the country’s largest pure-play supermarket chain with 2,760 stores, saw its online grocery sales surge 66% last year to an impressive $1.5 billion increase. … CEO Rodney McMullen told analysts on the first-quarter earnings conference call last week that the chain went from having no online sales at all in 2014 to an annual run rate of $5 billion in 2018, which he expects to trend toward an annual run rate of $9 billion going forward.

Rich Duprey, The Motley Fool

Kroger has exclusive rights to use Ocado technology & they are jointly developing a fulfillment center in Forest Park, Georgia. If Walmart’s stock is getting credit for online ecommerce growth & innovation (even after internal culture conflict stories leak, killing the narrative & Jet growth runs in reverse) then Kroger should at some point also enjoy the narrative shift as well.

I have been pulled in so many directions recently. It feels like right on the edge of chaos, yet somehow still drowning in opportunity.