Google is drawing regulatory scrutiny from the United States Department of Justice, which has sent their stock sliding about 7% so far today.

At this point, Google has literally almost nobody on their side in the political game. Everyone has a reason to hate them. Republicans think they squelch free speech that does not align with their political bias. Democrats think they are too economically powerful & use their monopoly to dominate smaller competitors (and, worse yet, they combined with Facebook & Russia to help get Trump elected).

Google is now off over 20% from where they were trading on April 29th, sliding from ~ $1,288 to around $1,027 a share.

One line in a WSJ article about the pending investigation is particularly absurd:

it created new design features like the “knowledge graph,” which populates the boxes that appear at the top of search, often answering a query without requiring the user to click through to another website. In March, 62% of Google searches on mobile were “no-click” searches, according to research firm Jumpshot. Google has argued that if consumers don’t find the rearranged content useful, they won’t click on it.

The bolded part directly contradicts Google’s historical behaviors when enforcing guidelines on others. When manually penalizing sites for link spam Google presumes the target site acquired the links on their own accord (even if they were built by a competitor). Google further justifies manual interactions on the basis that perceived attempts to manipulate the result set are verboten, not that searchers are so sophisticated that they can easily skip over any lower quality stuff that makes its way to the top.

They’ve recently redesigned their mobile search results while making both domain names & their ad labeling less obvious. That & other changes (like adding favicons to organic results to make the organic results look like ads & scrollable local results) should juice earnings, but the broader narrative of perceived risk certainly creates incentive for some people to lighten up their positions.

Making domain names less obvious will push more brands to bid on their own brand as a broad-match keyword in order to try to curtail phishing & other forms of lowbrow brand arbitrage which will now take off since the search results usually no longer show the domain name the content came from.

My guess is during this quarter Google constrains infrastructure spending, has blow out revenue growth (in addition to the mobile shifts mentioned above, some YouTube vids have double pre-roll & post-roll ads) AND announces a buyback. Though they only have a month left in the current quarter to drive blow out revenues.

The Google narrative likely has another day or two of spook out ahead of it, but I wouldn’t be against putting on a small position of a few shares of it here. I haven’t yet (largely because I dislike them :D) but if they slide below $1,000 a share at some point much of the risk is priced out of the stock.

Their big issue (in addition to the regulatory pressure) is Amazon is rapidly growing their ad business & Google seems unlikely to compete on the logistics front with Amazon unless Google were to acquire companies like Target & Kroger, but their ability to pull off those sorts of acquisitions is diminished when they are already under regulatory scrutiny.

Whenever they start reporting YouTube as a separate revenue stream (like Amazon.com did with AWS) that should lead to a good move higher in the stock. Though investors will likely remain in a wait-and-see mode given the recent slowdown in revenue growth & new regulatory headwinds. And they will still want to attribute a massive portion of their overhead costs & infrastructure costs to YouTube to show low margins on that. If they show high margins they’ll get revenue re-negotiation from a lot of players AND they look even worse each time an article like today’s NYT feature On YouTube’s Digital Playground, an Open Gate for Pedophiles gets published.

Growth has outperformed value for nearly a decade.

“Value stocks are either cheap for a good reason or cheap because of (unfairly) low expectations,” Patrick O’Shaughnessy, CEO and Portfolio Manager at O’Shaughnessy Asset Management, told IBD. “The market has left a lot of these stocks too cheap,” he said, but he can’t tell you when things will turn around. “Any good value investor knows how to suffer.”

Retail is once again dead

Amazon.com is also apparently going to get investigated by the FTC. They’re off 4.5%

The FTC’s plans for Amazon and the Justice Department’s interest in Google are not immediately clear. But the kind of arrangement brokered between the Justice Department and the FTC typically presages more serious antitrust scrutiny, the likes of which many Democrats and Republicans on Capitol Hill have sought out of fear that tech companies have become too big and powerful.

And so is Facebook. They’re off about 7.5% today.

The Times They Are a Changin’

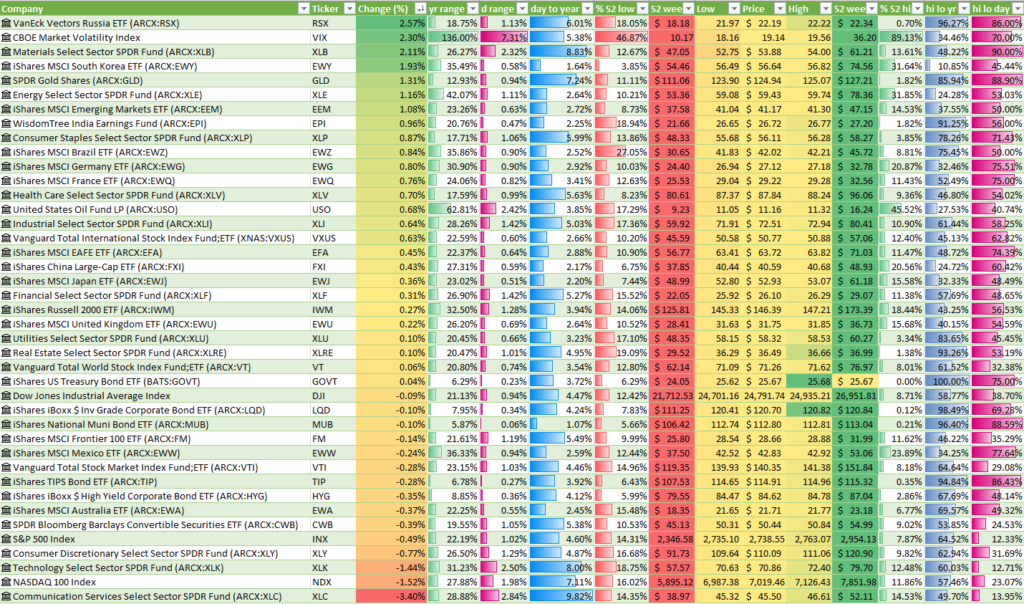

Here is a snapshot of the market today.

FANG pulled down communications, the Nasdaq 100 & the S&P 500, while defensive sectors like healthcare, consumer staples, etc. and haven assets like gold are up on the day.

As government bond yields fall they make corporate bonds & bond alternatives (like REITs & value stocks) look more appealing by both offering higher relative yields AND having lower debt service costs (provided yield spreads do not blow out).