It appears as though Winnie the Pooh has figured out the market.

On ultra dovish Fed the market jumped slightly & then sold off, then was on fire the following day & on day 3 just ahead of a weekend it appears to have changed directions once more.

Yesterday even some low beta value plays were up 2 or 3 percent. Today many of those have given back a percent or more.

I sold my remaining Kroger (KR) near open & they’ve since slid a bit. Yesterday I sold my remaining Weyerhaeuser (WY).

One of the stocks that didn’t take part in the rally yesterday (& in fact slid a bit) was PetMeds Express (ticker symbol PETS). They trade at about a 10X P/E ratio & are close to the 2018 December panic lows. They have no debt & about a quarter of their market cap is cash on hand & inventory, so their actual PE is closer to about 7.5 or 8. Their dividend yield is above 5% now. They actually slid a bit more today & were within pennies of new lows before jumping a bit.

The thesis for why they would be a doomed value trap with no hope would be that Chewy keeps eating marketshare (more memorable brand name, faster growth, sells a broader array of products, is playing the Amazon.com growth over profits model, etc.) as the debt-levered parent company PetSmart got a reprieve from genuine market prices on debt as the Federal Reserve hinted at the QE lite program they’ll soon engage in.

On the surface, the sharp decline in 2 year yields did not seem to make sense following the FOMC decision. After all. the Fed was dovish but did not show signs of cutting rates, but the 2-year yield went through the fed funds rate. That did not seem to make sense. However, when taking into account the QE-lite policy that will heavily skew toward the short end of the curve, the move makes more sense. Not to mention when taking into account the lack of FOMC conviction on returning to hikes, the decline in the 10-year also makes sense. … This might be one of the more underappreciated FOMC decisions in recent memory. The Fed is unequivocally retreating from any further tightening for the foreseeable future. How powerful will QE-lite prove to be? That is difficult to answer, but it is likely to show itself most forcefully in the dollar and lower short-term yields.

Samuel E. Rines, Avalon Advisors

According to S&P Global Ratings on November 8, 2018, PetSmart had the following debt structure:

- $955 million asset-based revolving credit facility (ABL revolver) (ABL agreement dated as of March 11, 2015)

- $4.3 billion first-lien term loan (credit agreement dated as of March 11, 2015)

- $1.35 billion first-lien secured notes (indenture dated as of May 31, 2017)

- $2.55 billion unsecured notes (indentures dated as of March 4, 2015, and May 31, 2017)

Last April the PetSmart acquisition of Chewy was described by Bloomberg as The Most Expensive Takeover in Retail Is Drowning in Debt:

PetSmart’s owners thought embracing e-commerce would keep it competitive in the age of Amazon.

Two chief executives and $3 billion later, they’re discovering it takes a lot more than web smarts to outrun an avalanche of debt.

The nation’s leading pet supplier has to figure out how to pay $8.1 billion in bond and loan maturities even as its sales and margins are shrinking. Half that debt traces back to a 2015 buyout led by private equity firm BC Partners, whose bidding was so aggressive that it actually topped its own offer to seal the deal, leaving veteran rivals agog at the final price.

The self spin off of a 20% stake in Chewy.com will likely mean the entities largely operate as parallels, rather than as a synergistic whole.

PetSmart’s bondholders had been expecting a spinoff of some of the equity in Chewy.com for months as the performance of PetSmart’s brick-and-mortar stores lagged behind while Chewy.com continues its rapid growth.

The company’s same-store sales have been falling for several quarters. By contrast, Chewy.com’s revenue jumped 81% to $760 million in its most recent quarter. Despite surging sales, the e-commerce business is still losing money.

That makes the justification for larding up so much debt on the company sort of moot (at least until the debt can be restructured & they force losses onto bondholders to lower the overall debt load). But seeing declining in-store sales, mounting losses on their online play, ongoing legal disputes with bondholders, etc. … Add that to the huge wave of IPOs that will come to market (Uber, Lyft, Slack, AirBNB, etc.) before Chewy.com could be fully spun out & an Amazon.com that is using ad revenues & cloud hosting profits to compete on prices … I don’t see how Chewy.com could IPO anytime soon.

Virtu was off a couple percent today but quickly recovered. Anytime the market keeps bouncing back and forth that one is frequently a solid play for a quick gain if it slides, as eventually some figure the outsized day to day churn ends up leaving more meat on the bone for an HFT market maker. Virtu sold off more in the July to October timeframe & then started improving as the broader stock market sold off.

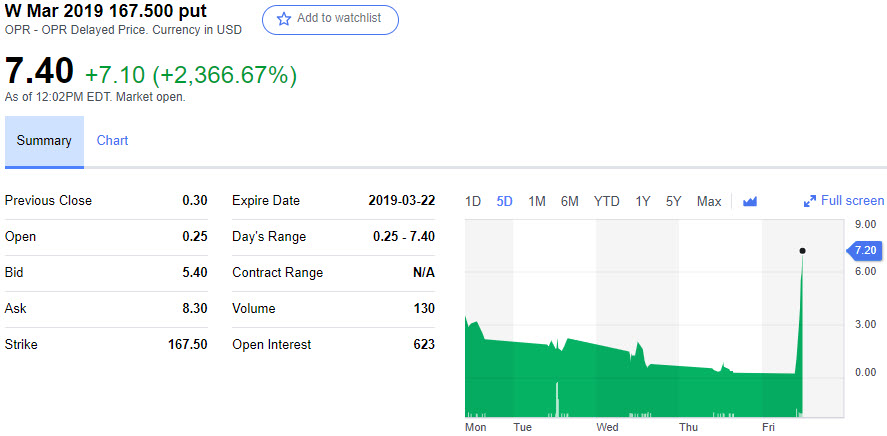

It looks like the market had a delayed reaction to the Fed’s move & that Wayfair put I bought the other day just shot the moon.

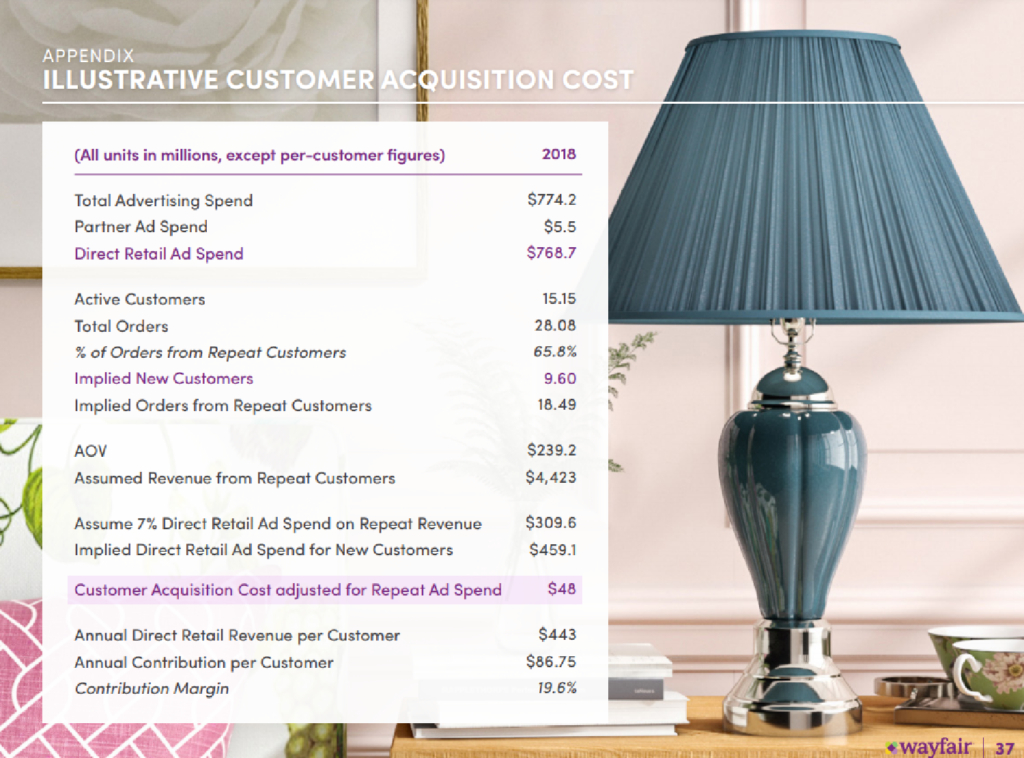

Great company, no idea why they’d sell off especially hard in a sell off. I mean, the fundamentals are utterly fantastic.

Last year, Wayfair’s operating expenses grew 8.5 percentage points faster than sales, causing operating losses to double. Despite this seeming lack of operating leverage, not all of Wayfair’s cash expenditures are accounted for on its profit and loss statement. Deep in the weeds of its 10-K, Wayfair discloses that it capitalises its “site and software development costs”, before amortising the asset over two years. In 2018, this had the effect of reducing operating losses by $63m, all else being equal. … In the face of less predictable and lumpier revenues, the market seems to think Wayfair’s future deserves the loftiest of valuations. Excluding Amazon, Wayfair’s 2.3 price-to-sales is higher than all its rivals, including The Home Depot, RH and Bed, Bath and Beyond, according to S&P Capital IQ. Of this bunch, it also has the second lowest gross margin — just 23.4 per cent — behind pseudo-crypto company Overstock.

Options are so much harder to trade than stocks because their value decays so fast unless the trade works out quickly. Wayfair aggressively promotes their growth narrative while their CEO sells ~ $5 million in stock each week & the shorts have been getting killed for years on it.

Great comment on the FT on their above linked article about Wayfair

Demand is highly cylical and intimately tied to housing sales.

Supply is often highly geared (e.g. DFS ‘buy’ now and don’t pay for a year) and dependent on credit sales (4 year or more) with a consequent high risk of default. Unlike cars, second-hand repossessed sofas have minimal value.

People buy furniture when they move house, and if and when it falls apart. It’s surprising how long you can make a sofa last, and tables can last forever. … Nearly all the furniture retail companies I have profiled over the years have gone bust, no matter how big.

manticore

If the market keeps sliding Wayfair is one to watch.