Coming into today lots of people were net long ahead of the Federal Reserve announcement & remembered the pain of the prior two meetings, so there was a sell off early in trading.

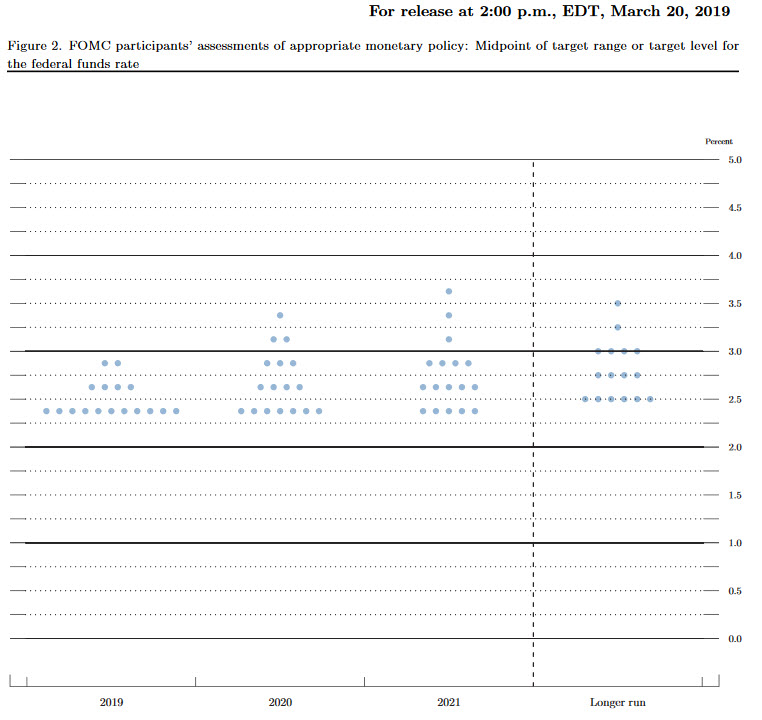

Those who put money to work ahead of the Fed’s announcement saw decent gains as the market recovered somewhat on the new scatter plots showing a low likelihood of any hikes this year & perhaps only about1 to at most 2 more hikes until rates are fully normalized over the longer term along while stating policy is currently neutral.

The Fed also announced that the balance sheet wind down would soon be wound down.

- The Committee intends to slow the reduction of its holdings of Treasury securities by reducing the cap on monthly redemptions from the current level of $30 billion to $15 billion beginning in May 2019. The Committee intends to conclude the reduction of its aggregate securities holdings in the System Open Market Account (SOMA) at the end of September 2019. The Committee intends to continue to allow its holdings of agency debt and agency mortgage-backed securities (MBS) to decline, consistent with the aim of holding primarily Treasury securities in the longer run.

- Beginning in October 2019, principal payments received from agency debt and agency MBS will be reinvested in Treasury securities subject to a maximum amount of $20 billion per month; any principal payments in excess of that maximum will continue to be reinvested in agency MBS.

- Principal payments from agency debt and agency MBS below the $20 billion maximum will initially be invested in Treasury securities across a range of maturities to roughly match the maturity composition of Treasury securities outstanding; the Committee will revisit this reinvestment plan in connection with its deliberations regarding the longer-run composition of the SOMA portfolio.

- It continues to be the Committee’s view that limited sales of agency MBS might be warranted in the longer run to reduce or eliminate residual holdings. The timing and pace of any sales would be communicated to the public well in advance.

- The average level of reserves after the FOMC has concluded the reduction of its aggregate securities holdings at the end of September will likely still be somewhat above the level of reserves necessary to efficiently and effectively implement monetary policy.

- In that case, the Committee currently anticipates that it will likely hold the size of the SOMA portfolio roughly constant for a time. During such a period, persistent gradual increases in currency and other non-reserve liabilities would be accompanied by corresponding gradual declines in reserve balances to a level consistent with efficient and effective implementation of monetary policy.

In case the Fed laid an egg I bought a put option on Wayfair, but quickly sold it after their release for a ~ $40 loss.

Yield on the 10-year looks to be testing 2019 lows. FANG and gold miners are both up a good bit while Virtu is off a couple percent.

As of writing this the Nasdaq is up about 2/3% while the S&P 500 is up a 3/10% & the DJIA is up about 1/20th a %.

Growth is clearly beating value today. Health stocks were off a bit today. And some value investors are exiting stage left in spite of bond yields falling.

Kroger’s lead director, Robert D. Beyer, who has been on the company’s board since 1999, sold 80,000 Kroger shares on Tuesday for a total of $1.96 million, an average price of $24.52 each. … Beyer’s sale—at a price that represents an 11% loss from the end of 2018—is the biggest sale unrelated to the exercise of stock options by a Kroger insider in six years