For the past couple quarters Zillow has slid after reporting quarterly results. The big themes on the slide were the erosion in the growth rate of their core business (selling ads to Realtors) coupled with new (perceived?) risks to their business from adding new business lines including lending and home flipping.

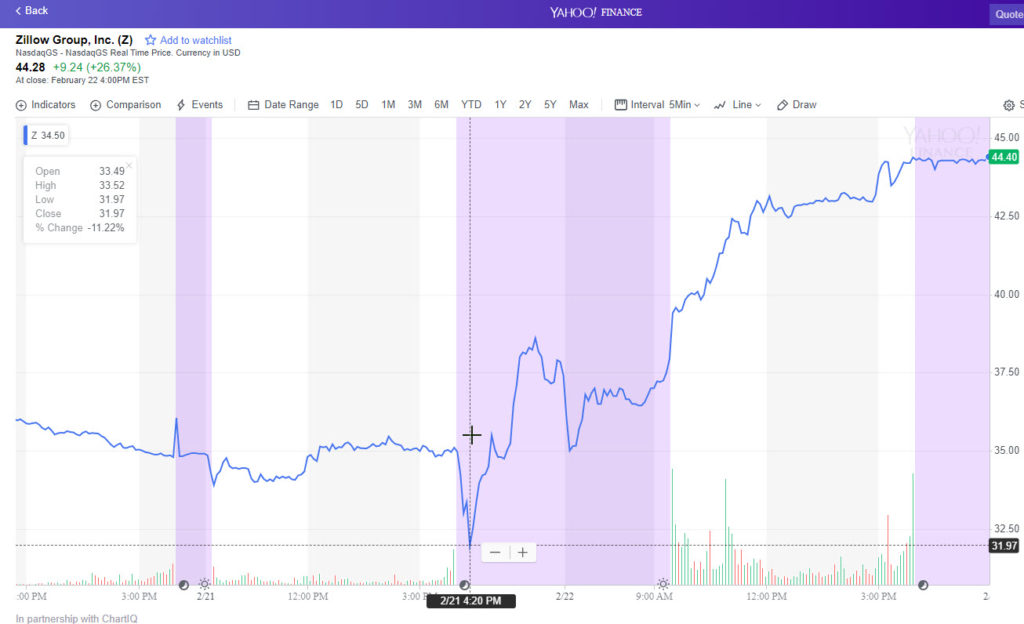

In after hours on the most recent quarter the stock immediately slid after reporting results, with the stock falling nearly 10% from $34.97 a share to $31.97. The stock then quickly reversed course, ending after hours at $37.94 & closing out the next day up an additional 26.37% during trade to end at $44.28 a share.

A quarter ago when Zillow announced results Jim Cramer mentioned how such a stock could torpedo a portfolio, they could still have a lot of downside & how the desperation among the company was “unbecoming.”

I am not surprised they jumped on the announcement they were changing CEOs back to Rich Barton & were aiming to create an extra $20 billion in revenues within 5 years by flipping up to 5,000 homes a month.

Even after the recent huge 35%+ swing in share price, Zillow is still valued at about $9 billion. At some point it would even make sense for someone like Massa to jump in and buy Zillow shares to maintain narrative control over his large investments in Opendoor. It is hard to claim the over $1 billion invested into Opendoor with a valuation now around $3.7 billion is rational if Zillow (which is the dominant player in the category) is only worth around $6 billion & jumping into the home flipping category is considered value eroding for Zillow.

If you had to create Zillow again from scratch you probably couldn’t, as such an effort would almost certainly get hit by the Google Panda algorithm. Further, Realtor.com, their most direct competitor in the search results, isn’t really closing the gap.

If you do the math on the home flipping, it is a lot of revenues, but is not a lot of profits. From a few recent interviews I have read, it sounds like Zillow is mostly interested in light-touch quick flips, and while that strategy certainly limits downside risk, there is also a limit to the size of the market & the profit potential in that market. In Q4 of last year Zillow made $1,723 in profit on the 141 homes it sold.

Zillow paid $264,134 on average per home it sold in the quarter, and spent over $20,000 per home on renovation and selling costs. Once interest and holding costs were taken into account, Zillow’s cost per home was $291,518 per home, meaning the $293,241 in revenue it generated per sale amounted to a 0.5% profit margin. Earlier in the year, when housing activity was stronger, Zillow appears to have generated more than twice the margin.

Forbes Staff writers Samantha Sharf & Antoine Gara

As Zillow and other iBuyer competitors scale up the home flipping business, they may be able to increase capacity utilization, but they likely will drive down margins on the business unless they go into tougher projects (greater risk + longer turnover times) and perhaps decide that their core business model is strong enough that they can afford risking pissing off Realtors and squeezing them out of the conversion process on their owned inventory.