TGT stock trades around where it was in July of 2007. In the decade plus since many specialty retailers have went under, been bought out by private equity, or have been bought out by private equity then went under. Every time a company like Toys R Us disappears it ultimately increases the value of Walmart, Target & Amazon.com.

Certain segments of the consumer dollar are relatively slow move online. This is a big part of why Amazon.com bought Whole Foods. Get great urban retail locations & own a slice of the market that seems not to be coming online very quickly. Walmart & Target also have large grocery businesses.

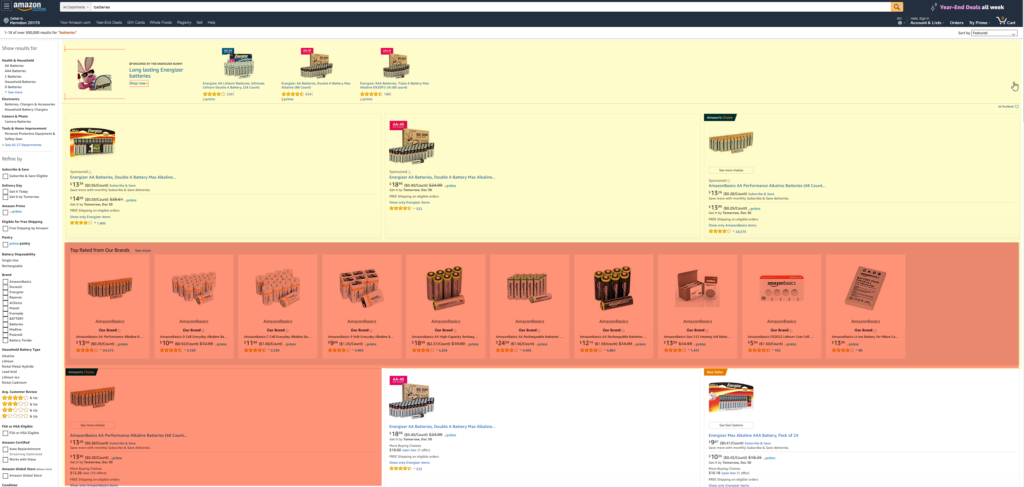

As time passes & Amazon has grown more dominant in ecommerce they have been able to turn their product search result pages into sort of a spam empire. First there’s a big banner ad, then there is another layer of ads, then there is a layer of private label products which eats up the rest of the above the fold screen space and forces brands to buy paid ads in addition to all the other fees Amazon charges (warehousing, logistics expenses, payment processing, etc.)

Amazon is the fastest growing scaled online ad network. And they are taking their profits & investing them into selling Fire sticks at or below cost, video game streaming via Twitch, IMdB Freedive, etc.

As they grow, they are also unveiling new ad features.

“New-to-brand metrics determine whether an ad-attributed purchase was made by an existing customer or one buying a brand’s product on Amazon for the first time over the prior year. With new-to-brand, advertisers receive campaign performance metrics such as total new-to-brand purchases and sales, new-to-brand purchase rate, and cost per new-to-brand customer.”

Amazon Advertising

That feature allows Amazon to over-state its own contribution to the conversion process. They will claim a customer is new to a brand if that customer had never bought that brand ON AMAZON.COM in the past year. This is a similar sort of self-over-attribution as what Google Analytics did with last click attribution over-crediting Google.com for conversions. Or like Facebook did with all their fake metrics on video views & how they give themselves a 28-day window for app install attribution after an ad click.

Part of making a lot of money with an ad network is the ability to not only drive attention, but the ability to over-claim conversion contribution to justify ever-increasing ad spend. Some data is shown, some is withheld. The selective display of data allows the aggregator platforms to give themselves an A+ in terms of ad spend ROI while also keeping partners reliant on them for further exposure.

The more ad networks you spend on in parallel the harder it is to untangle what drove what as everybody wants to overclaim their contribution to the conversion.

If large retailers run low margin businesses pushing 10s or 100s of billions of dollars in product each year & see piles of high margin ad revenues available, at some point it makes sense for them to aggressively compete against Google rather than relying on Google. And they won’t catch up to Amazon on the ad revenue front if they are reliant on a third party like Google for managing their ad inventory.

Walmart recently disappeared from Google Express.

If Google Express lost Target they’d have major product gaps. And Apple Pay is rolling out widely. So long as all the major platforms are balkanized (be it video streaming, video game stores, cloud computing services, ads, ecommerce marketplaces, operating systems, payment platforms, etc.) then at some point to be more efficient Google will need an internal customer which provides the baseline level of service quality to handle retail logistics profitably. Google Express has went nowhere and only seems to be falling further behind Amazon.com in the US, let alone the sort of amazing stuff Amazon.com is doing in India.

“The Seattle giant has modified its app to work with inexpensive smartphones and patchy cellular networks. It has added hundreds of thousands of Indian language descriptions of products and videos for those who can’t read, and it has opened physical Amazon stores to walk people through the process of ordering online. It brought on tens of thousands of local distributors to deliver packages, often by bicycle down dirt roads, where it will accept cash or digital payment on delivery.” … “Seated at linked computer screens, the customers, most of whom aren’t comfortable with English or typing, can follow along as he pulls up options. He helps them pick the right size using a chart on the wall and a foot measuring device. Later, customers come back to pick up their orders and pay cash at the store. There is even a changing room so they can try on clothes before paying. “It helps me introduce people to the strange new world of the internet, where they can buy everything, try it and even return it,” said Mr. Arjun. He gets an 8%-10% commission on sales. … Humans translated descriptions for 35,000 of Amazon’s most popular products into Hindi. That allowed a machine-learning system to master the language, and eventually every product description will be translated. Amazon said it plans to add voice searches and descriptions in other major Indian languages.”

WSJ article on Amazon’s success in rural India

Google is going to keep getting clipped by the EU, so they probably wouldn’t want to acquire an eBay anytime soon, as they still wouldn’t solve their logistics problems AND they would open themselves up to another wave of fines from Margrethe Vestager.

Target is one of the few US retailers with a broad range of products & a broad base of stores. Other than them and Walmart, who else could Google acquire to finally be competitive against Amazon in ecommerce & local delivery in a game where Walmart is opting out of partnering with Google?

I haven’t bought any Target yet, but if the market heads south for a bit I wouldn’t mind establishing a position that was a bit set-and-forget for a couple years.