ROKU was on fire yesterday as the market turned up. It is already up over 90% so far this year, in part due to a particularly weak performance as the stock market cratered in Q4 last year.

A few weeks ago analyst after analyst downgraded Roku, but on Monday Susquehanna analyst Shyam Patil upgraded it on the thesis that cord cutting is a trend which will continue for a long time to come.

“The connected TV advertising market is inflecting as engagement continues to shift from linear to digital. ROKU is one of the few scaled plays on this trend,” he wrote.

Young people view Netflix as the most important video brand by a wide margin. People under the age of 35 also put Hulu & Amazon Prime Video in their top 5.

AT&T just shed another half-million TV subscribers in the most recent quarter.

AT&T lost a net 544,000 premium TV subscribers, a category that includes DirecTV satellite and U-verse television customers. Analysts had expected a loss of 385,000 customers across DirecTV and U-verse, according to research firm FactSet.

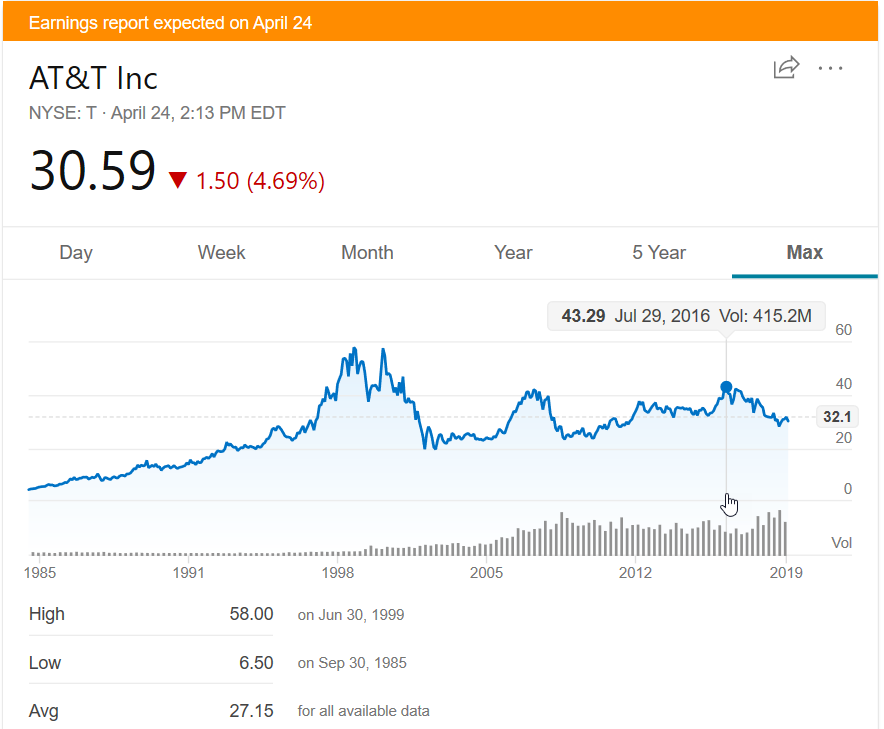

Their stock is off almost 5% today ($1.57 or 4.9%). With a quarterly dividend of 51 cents that is over 3/4 a year that just went poof. Anyone who sells now instead of yesterday is undoing most of a year’s worth of income from the stock. And if that income was taxed at 23.8% the day’s slide is a whole year’s worth of income.

Add up a few nasty quarters like that & it really ads up.

Since July 29, 2016 the stock slid from $43.29 to $30.59 (as of typing this). That is a $12.60 slide per share. As July 29 was past the July 9 ex-div date that means shareholders who bought that top did not get the next quarterly dividend payment that August. So they’ve earned $5.46 in dividends over nearly 3 years, amounting to half of the stock’s decline & then that income was also taxed.

| Ex/Eff Date | Dividend | Declared | Recorded | Paid |

| 4/9/2019 | 0.51 | 3/29/2019 | 4/10/2019 | 5/1/2019 |

| 1/9/2019 | 0.51 | — | 1/10/2019 | 2/1/2019 |

| 10/9/2018 | 0.5 | 9/28/2018 | 10/10/2018 | 11/1/2018 |

| 7/9/2018 | 0.5 | 6/29/2018 | 7/10/2018 | 8/1/2018 |

| 4/9/2018 | 0.5 | 3/30/2018 | 4/10/2018 | 5/1/2018 |

| 1/9/2018 | 0.5 | 12/15/2017 | 1/10/2018 | 2/1/2018 |

| 10/6/2017 | 0.49 | 9/29/2017 | 10/10/2017 | 11/1/2017 |

| 7/6/2017 | 0.49 | 6/30/2017 | 7/10/2017 | 8/1/2017 |

| 4/6/2017 | 0.49 | 3/31/2017 | 4/10/2017 | 5/1/2017 |

| 1/6/2017 | 0.49 | 10/24/2016 | 1/10/2017 | 2/1/2017 |

| 10/5/2016 | 0.48 | 9/30/2016 | 10/10/2016 | 11/1/2016 |

That AT&T performance looks absolutely fantastic when compared against a bombed out Tupperware (TUP) which raised its dividend yield about 10% today by having the stock slide over 9% on negative sales growth. In the age of Instagram who goes to Tupperware parties?

Anyone who bought yesterday might offset that decline in a couple years provided the dividend is not cut.

Painful.

It is very easy to see new verticals & market shifts as fads early on in the shift, but if you compound a decade or two of strong growth it adds up.

Two decades ago the Internet was a fad & a bubble.

A decade ago mobile was a fad. Today if you interact with the public regularly in an urban area it is hard to go a whole day without being pissed off by some unaware cell phone user cutting you off or running into you.

People have become embedded apps in their cell phones. Thus mobile constitutes the majority of online ad spend – over 70% of the total online ad spend.

We forecast digital ad spending will rise 17.1% to $327.28 billion in 2019 … Mobile represents a significant portion of total media ad spending as well, and we forecast it will get $232.34 billion in 2019.

eMarketer

Who really cares if something is a fad if it goes up 60,000%? A fad that doesn’t end & enjoys growth long enough can no longer be described accurately as a fad, even if it is terrible.

The California-based company’s unparalleled stock rally reflects its steady growth. It has boosted revenues by at least 9% every year since 2001

And would plants crave it if it wasn’t good?

JUUL was a fad. Ignoring it proved costly:

“Youth use of e-cigarettes jumped 78% between 2017 and 2018—to one out of every five high-school students—thanks largely to the popularity of Juul. … Altria first tried to buy the entire company in late 2017 or early 2018 with an informal offer of as much as $8 billion, according to people familiar with the matter. That approach, previously unreported, was rebuffed. Mr. Willard eventually sweetened the offer and settled for a minority stake. He also agreed to put Juul coupons on packs of Marlboros, giving his own consumers an incentive to try Juul.”

This, incidentally, is also why value investing can be so painful.

While “the future” can be priced at infinite through rose colored glasses driven by compound growth & the imagination of what is possible, existing players who are getting disrupted need to spend aggressively while their growth falls to nothing or even turns negative.

Also from the above linked WSJ article:

It’s the dilemma facing many established companies in mature markets. How should one respond to new entrants that are disrupting the status quo, when the classic strategy—buy the disrupter—could potentially speed the decline of the legacy business? PepsiCo Inc. and Coca-Cola Co. have shifted away from sugary sodas by scooping up coconut water, coffee and kombucha. Big media companies such as Walt Disney Co. and AT&T Inc. are launching their own streaming services as they chase consumers who are cutting the cord. Walmart Inc. has invested billions in e-commerce sites such as Jet.com and India’s Flipkart as the retail giant works to fend off Amazon.com Inc

A 4%, 5%, 6% or 7% dividend can sound quite appealing at first glance. But that income is instantly realized & taxed. If the company has a crappy quarter the stock can lose a half-year or multiple years worth of coupon in a day. So you pay income tax on the dividend that does not even compensate for the capital decline.

If that dividend payment gets cut pain compounds on top of pain as many dividend investors consider a declining dividend to be a sell signal, locking in further losses for existing debt holders. What’s more, many value stocks carry a high debt load from acquisitions and/or buying back their own stock. So you end up hoping either the debt can be paid down or a new growth channel emerges before the profit pool goes away. Each quarter the dividend payments must be made while debts are serviced & rolled over.

As rates go up, bonds become relatively more attractive than equities (particularly equities that have a bunch of debt associated with them & a dividend that might get cut as debt service costs rise).

The future is anything but certain.

But the emotional pain is real.

And you must be willing to eat that pain long enough for either the company to fight through market changes, or for analysts to believe in a different narrative of the company. And while you do so, you are underperforming the index almost every day until the bull market ends.

“Growth shares have surged to the highest levels versus cheap equities since the dot-com bubble, underscoring fierce demand for companies less exposed to the gyrations of the economic cycle. Stocks posting a strong return on equity are near their most expensive since 1990, according to Sanford C. Bernstein & Co. To cap it all, tech multiples have jumped toward 2009 highs relative to the broader gauge. It all suggests an “extreme” valuation gap is setting the stock market up for a rotation away from winners in favor of the losers, according to Morgan Stanley, echoing a growing number of Wall Street strategists. … the most-loved equities look decidedly expensive in this melt-up. And all bets are off on how they will fare in any correction, with the projected earnings expansion for growth stocks this year not much stronger than peers”

And even outperformance in a crash could mean still losing, but losing slightly less than the index.

To some degree, this is why momentum investing can be more rewarding than value investing. The shifts come quickly & you often know if you are right or wrong in short order. Whereas with a value play you can eat pain for months or years before it finally turns around – or not.

This is part of why it can help to have multiple brokerage accounts. One for active management where you regularly take score, buy good set ups & regularly enter & exit positions. Then the other account where the value investments are segregated into something you rarely look at & the daily noise of the market doesn’t have any impact on.